In this article, you will learn about the rise of crowdfunding and how it is revolutionizing fundraising. Crowdfunding is a way for individuals and organizations to raise money online by collecting small amounts of money from a large number of people. It has become increasingly popular in recent years as a way to fund creative projects, startup businesses, and even charitable causes. By the end of this article, you will have a better understanding of how crowdfunding works and how it is changing the way we think about fundraising.

One of the reasons why crowdfunding has become so popular is because it allows anyone with a good idea or a compelling cause to raise money. In the past, fundraising was often limited to more traditional methods like seeking venture capital or applying for grants. With crowdfunding, anyone can create a campaign and share it with their network, potentially reaching a much larger audience. Crowdfunding platforms like Kickstarter and Indiegogo have made it easy for people to contribute to campaigns and track the progress of their donations. This democratization of fundraising has opened up new possibilities for individuals and organizations who may not have had access to traditional fundraising channels.

Overview of Crowdfunding

Crowdfunding has revolutionized the way fundraising is done, providing individuals and businesses with access to capital in a new and innovative way. In this article, we will explore the definition of crowdfunding, its historical background, and how it has transformed the fundraising landscape.

Definition of crowdfunding

Crowdfunding is a method of raising funds through the collective effort of a large number of people, usually via the internet. It allows individuals, startups, and organizations to raise money for a project or venture by receiving small contributions from a large number of people.

Historical background

The concept of crowdfunding is not a new phenomenon. In fact, it can be traced back to the 17th century, where it was used to raise funds for public projects such as the construction of monuments. However, it was in the early 2000s that the internet and social media platforms provided the perfect environment for the growth of crowdfunding.

Transformation of fundraising methods

Prior to the rise of crowdfunding, traditional fundraising methods involved seeking funding from banks, venture capitalists, or angel investors. These methods were often inaccessible to entrepreneurs and startups, as they required significant capital and an established track record.

However, crowdfunding has democratized fundraising, allowing anyone with a good idea and a compelling story to raise funds directly from the public. With platforms such as Kickstarter and Indiegogo, individuals can now bypass traditional funding channels and connect directly with potential backers.

Types of Crowdfunding

There are several types of crowdfunding, each with its own unique characteristics and purposes. Let's explore some of the most common types:

Reward-based crowdfunding

Reward-based crowdfunding is the most popular type of crowdfunding and involves individuals contributing money to a project in exchange for a reward. This reward can vary depending on the amount contributed and may include a product, service, or other incentives.

Equity-based crowdfunding

Equity-based crowdfunding, also known as investment crowdfunding, allows individuals to invest in a company or project in exchange for equity or shares. This type of crowdfunding has gained traction in recent years, especially with the passage of the Jumpstart Our Business Startups (JOBS) Act in the United States.

Donation-based crowdfunding

Donation-based crowdfunding involves individuals contributing money to a project or cause without expecting any financial return. This type of crowdfunding is commonly used for charitable causes, medical expenses, and disaster relief efforts.

Debt-based crowdfunding

Debt-based crowdfunding, also known as peer-to-peer lending or crowdfunding loans, allows individuals to lend money to a project or individual with the expectation of repayment with interest. This type of crowdfunding is similar to traditional lending, but it is facilitated through online platforms.

Benefits of Crowdfunding

Crowdfunding offers numerous benefits for both entrepreneurs and backers. Let's explore some of the key advantages:

Access to capital for startups and entrepreneurs

One of the main benefits of crowdfunding is that it provides access to capital for startups and entrepreneurs who may have difficulty obtaining funding from traditional sources. By tapping into the power of the crowd, entrepreneurs can showcase their ideas and secure financial support from individuals who believe in their vision.

Engagement and support from the crowd

Crowdfunding is not just about raising money; it is also about building a community and engaging with the crowd. Backers often become advocates for the project, spreading the word and attracting even more supporters. This engagement and support from the crowd can provide valuable feedback, mentorship, and connections for the project creator.

Market testing and validation

Launching a new product or service can be risky, as there is always the possibility that it may not resonate with the target audience. Crowdfunding allows entrepreneurs to test the market demand for their idea before fully launching it. By gauging the level of interest and financial support received, entrepreneurs can validate their concept and make necessary adjustments before investing significant resources.

Diversification of funding sources

Traditional fundraising methods often rely on a limited number of investors or lenders. Crowdfunding, on the other hand, allows entrepreneurs to tap into a larger pool of potential backers. By diversifying their funding sources, entrepreneurs can mitigate the risk of relying on a single investor or lender and increase their chances of successfully raising the necessary capital.

Crowdfunding Platforms

Crowdfunding platforms have played a crucial role in the growth and success of the crowdfunding industry. These online platforms provide a space for project creators to showcase their ideas, engage with potential backers, and raise funds. Let's explore some popular crowdfunding platforms and the services they offer:

Popular crowdfunding platforms

-

Kickstarter: Kickstarter is one of the most well-known reward-based crowdfunding platforms. It has helped fund numerous creative projects, including films, music albums, and innovative gadgets.

-

Indiegogo: Indiegogo is another popular reward-based crowdfunding platform. It offers flexible funding options, allowing creators to keep the funds raised even if they don't reach their initial funding goal.

-

Seedrs: Seedrs is a prominent equity-based crowdfunding platform that focuses on early-stage startups. It provides a platform for entrepreneurs to raise capital in exchange for equity.

Features and services offered

Crowdfunding platforms offer a range of features and services to support project creators and backers. These may include project promotion tools, payment processing, campaign analytics, and backer communication tools. Some platforms also provide additional services such as marketing support, legal guidance, and investor matchmaking.

Success stories of projects funded through platforms

Crowdfunding platforms have witnessed numerous success stories over the years. From blockbuster movies like “Veronica Mars” to groundbreaking products like the Oculus Rift virtual reality headset, these platforms have helped bring countless projects to life. These success stories serve as inspiration for aspiring entrepreneurs and demonstrate the transformative power of crowdfunding.

Crowdfunding Regulations

As crowdfunding continues to grow in popularity, governments around the world have begun to implement regulations to ensure investor protection and maintain the integrity of the industry. Let's explore some of the key regulatory frameworks:

Regulatory framework for crowdfunding

Regulatory frameworks for crowdfunding vary from country to country. They typically cover areas such as investor eligibility, fundraising limits, disclosure requirements, and platform operator obligations. These regulations aim to strike a balance between promoting innovation and protecting investors from potential risks.

SEC regulations in the United States

In the United States, crowdfunding is regulated by the Securities and Exchange Commission (SEC) under Title III of the JOBS Act. These regulations, known as Regulation Crowdfunding, impose certain requirements on both project creators and backers to ensure transparency and investor protection.

EU regulations on crowdfunding

The European Union (EU) has also implemented regulations on crowdfunding to foster cross-border crowdfunding activities within its member states. The EU framework establishes common rules for crowdfunding platforms, including licensing requirements, investor protection measures, and disclosure obligations.

Impact of regulations on the industry

While regulations aim to protect investors and maintain market integrity, they can also pose challenges for crowdfunding platforms and project creators. Compliance with regulatory requirements can be complex and costly, particularly for smaller platforms and startups. However, these regulations can also enhance investor confidence and contribute to the long-term sustainability of the crowdfunding industry.

Case Studies

To better understand the impact and potential of crowdfunding, let's explore some real-life case studies:

Successful crowdfunding campaigns

-

Pebble Time Smartwatch: In 2012, Pebble Technology raised over $10 million through Kickstarter to develop its smartwatch. This campaign was a groundbreaking success and demonstrated the appetite for innovative technology among crowdfunding backers.

-

Exploding Kittens: Exploding Kittens is a popular card game that raised $8.7 million on Kickstarter in 2015. The campaign attracted widespread attention and became one of the most successful crowdfunding projects of all time.

Lessons learned from failed campaigns

-

Coolest Cooler: Despite raising over $13 million on Kickstarter, the Coolest Cooler project faced challenges in delivering the promised product to backers. This campaign highlights the importance of proper project planning, supply chain management, and communication with backers.

-

Zano Drone: The Zano Drone project raised £2.3 million on Kickstarter but failed to deliver the final product. This campaign serves as a reminder of the risks associated with ambitious projects and the need for realistic planning and execution.

Crowdfunding for Social Causes

Crowdfunding has become a powerful tool for raising funds for social causes and charitable projects. Let's explore how crowdfunding has contributed to social impact initiatives:

Role of crowdfunding in raising funds for charitable causes

Traditional methods of fundraising for charitable causes often involve soliciting donations from a limited number of individuals and organizations. Crowdfunding, on the other hand, enables individuals and nonprofits to reach a much wider audience and generate support from people who may not have been previously aware of their cause.

Examples of successful social impact projects funded through crowdfunding

-

ALS Ice Bucket Challenge: The ALS Ice Bucket Challenge, which went viral in 2014, raised over $220 million for the ALS Association. This campaign demonstrated the power of social media and crowdfunding in mobilizing support for a charitable cause.

-

Solar Roadways: Solar Roadways is a project that aims to transform roads into solar panels. It raised over $2.2 million on Indiegogo, allowing the project creators to develop and test their innovative technology.

Challenges and Risks

While crowdfunding offers numerous benefits, it is not without its challenges and risks. Let's explore some of the potential downsides:

Potential for fraud and scams

The open and accessible nature of crowdfunding platforms makes them vulnerable to fraudulent campaigns and scams. Fake projects may lure backers with promises of innovative products or high returns, only to disappear once the funds are collected. Backers should exercise caution and conduct due diligence before contributing to any crowdfunding campaign.

Lack of investor protection

Despite regulatory efforts, crowdfunding investments still carry certain risks, and investors may not have the same level of protection as traditional investors. This lack of investor protection can leave backers susceptible to potential financial losses if a project fails to deliver on its promises.

Limitations for certain types of projects

While crowdfunding has been successful for many creative projects and startups, it may not be suitable for all types of ventures. Projects that require significant upfront capital, such as large-scale infrastructure projects, may face challenges in attracting crowdfunding support. Additionally, projects that lack a compelling narrative or are not easily understood by the general public may struggle to gain traction.

Future Trends in Crowdfunding

The crowdfunding industry is constantly evolving, and we can expect to see several future trends:

Emerging technologies and platforms

Advancements in technology, such as blockchain and smart contracts, have the potential to transform crowdfunding by increasing transparency, enhancing security, and reducing transaction costs. These innovations could make crowdfunding even more accessible and efficient for both project creators and backers.

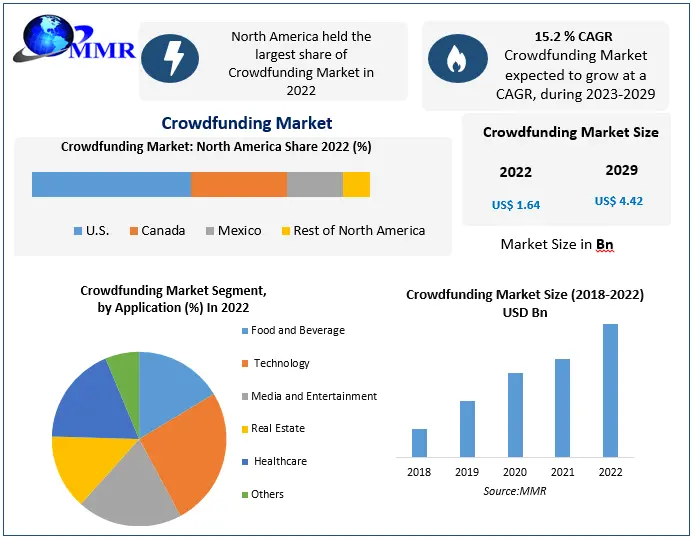

International expansion of crowdfunding

While crowdfunding started primarily in the United States, it has since gained traction worldwide. We can expect to see further international expansion, with more countries developing their own crowdfunding ecosystems and regulations. This expansion will open up new opportunities for entrepreneurs and investors on a global scale.

Integration with other fundraising methods

Crowdfunding is not intended to replace traditional fundraising methods, but rather to complement them. In the future, we may see increased integration between crowdfunding and other methods, such as venture capital and angel investing. This integration could create more diverse funding options for entrepreneurs and provide a seamless experience for backers.

Impact of Crowdfunding

The rise of crowdfunding has had a profound impact on fundraising and the startup ecosystem. Let's explore some of the key implications:

Disruption of traditional fundraising models

Crowdfunding has disrupted the traditional fundraising landscape by providing an alternative funding source that is accessible to a wider audience. It has empowered individuals and small businesses to turn their ideas into reality, bypassing traditional gatekeepers and democratizing the fundraising process.

Empowerment of individuals and small businesses

Crowdfunding has given individuals and small businesses a voice and an opportunity to showcase their ideas to a global audience. It has leveled the playing field, enabling entrepreneurs to compete with established players and gain recognition based on the merit of their projects.

Economic and societal implications

The growth of crowdfunding has had broader economic and societal implications. It has led to job creation, innovation, and increased economic activity. Additionally, crowdfunding has fostered a sense of community and collaboration, as backers become personally invested in the success of the projects they support.

Success Factors in Crowdfunding

To maximize the chances of success in crowdfunding, project creators should consider the following factors:

Effective project presentation

A compelling project presentation is essential to capturing the attention and support of potential backers. This includes a clear and concise description of the project, an engaging video or visual content, and a compelling story that resonates with the target audience.

Building a strong community

Building a strong community of supporters is crucial for crowdfunding success. Project creators should engage with their backers, provide regular updates, and foster a sense of belonging and ownership in the project. This community can serve as a valuable source of support, feedback, and future promotion.

Engaging with backers

Communication and transparency are key to maintaining a positive relationship with backers. Project creators should respond to inquiries and feedback in a timely manner, provide regular updates on the project's progress, and address any concerns or challenges that may arise.

Setting realistic funding goals

Setting realistic funding goals is essential to building credibility and trust with potential backers. Ambitious goals may be perceived as unrealistic or lacking in planning, while overly conservative goals may undermine the project's potential. Project creators should carefully calculate their funding needs and clearly communicate their intended use of the funds.

Crowdfunding Ethics

As with any fundraising method, crowdfunding comes with ethical considerations for both project creators and backers:

Transparency and accountability

Project creators should be transparent about their intentions, plans, and risks associated with their project. They should provide accurate and truthful information to potential backers and be accountable for the funds raised. Backers, on the other hand, should conduct due diligence before contributing to a crowdfunding campaign and be aware of the risks involved.

Ethical considerations for backers and entrepreneurs

Backers should pledge funds to projects they genuinely believe in and align with their values. They should refrain from making false promises or manipulating project creators. Similarly, project creators should avoid exaggerating claims, misrepresenting the project, or using deceptive tactics to attract backers.

Criticism of Crowdfunding

Despite its many benefits, crowdfunding has faced criticism on several fronts. Let's explore some of the main concerns raised:

Income inequality concerns

Critics argue that crowdfunding may exacerbate income inequality, as projects that cater to the interests of affluent individuals or that have a strong social media presence are more likely to receive funding. This can create a disparity in access to capital for projects that address important social issues but may not have the same visibility.

Overhyped expectations

The success stories of crowdfunding can create inflated expectations among project creators and backers. Many believe that crowdfunding is a quick and easy way to raise funds without fully understanding the challenges and risks involved. This can lead to disappointment and frustration if projects fail to meet expectations.

Lack of long-term sustainability

Crowdfunding primarily focuses on the initial funding stage of a project, but it may not provide a sustainable source of ongoing funding. Once a project has been successfully funded, project creators need to manage their resources effectively to ensure long-term viability and success.

Conclusion

The rise of crowdfunding has revolutionized the way fundraising is done, giving individuals and businesses the power to access capital in a new and innovative way. From its humble roots in the 17th century to the explosion of platforms like Kickstarter and Indiegogo, crowdfunding has transformed the fundraising landscape.

Through reward-based crowdfunding, equity-based crowdfunding, donation-based crowdfunding, and debt-based crowdfunding, individuals and businesses have a variety of options to raise funds for their projects. Crowdfunding platforms have played a crucial role in facilitating these transactions, offering a wide range of features and services.

While crowdfunding offers many benefits, it also poses challenges and risks. Fraud and scams are always a concern, and investor protection remains an issue. Additionally, crowdfunding may not be suitable for all types of projects and can contribute to income inequality.

Looking forward, crowdfunding is expected to continue growing and evolving. Emerging technologies, international expansion, and integration with other fundraising methods are some of the trends we can expect to see. Crowdfunding has disrupted traditional fundraising models, empowering individuals and small businesses, and contributing to economic and societal development.

To succeed in crowdfunding, project creators should present their projects effectively, build a strong community, engage with backers, and set realistic funding goals. Transparency and accountability are crucial for maintaining ethical standards in the crowdfunding space.

In conclusion, crowdfunding has revolutionized fundraising, providing a platform for individuals and businesses to showcase their ideas, mobilize support, and access capital. While it is not without its challenges and critics, the potential for continued growth and innovation in the industry is immense. Crowdfunding has opened doors and opportunities for aspiring entrepreneurs, reshaping the fundraising landscape for years to come.