Invest in StartEngine and take the first step towards building your financial future. In this article, you will learn about the opportunities that StartEngine offers for investors like yourself. Whether you are a seasoned investor or just starting out, StartEngine provides a platform where you can discover and invest in exciting startups and innovation-driven companies.

At StartEngine, you have the chance to diversify your portfolio and support the growth of innovative businesses. With a wide range of investment opportunities available, you can choose from various industries and find the right company that aligns with your interests and investment goals. StartEngine also provides valuable resources and information, allowing you to make informed decisions and stay updated on the progress of your investments. So, why wait? Visit startengine.com today and begin your journey towards investing in the future.

Invest in StartEngine

What is StartEngine?

A brief introduction to StartEngine

StartEngine is a leading investment crowdfunding platform that allows individuals to invest in early-stage companies and startups with as little as $100. Founded in 2014 by Howard Marks and Ron Miller, StartEngine has revolutionized the way companies raise capital by providing a platform where entrepreneurs can showcase their businesses and investors can discover promising investment opportunities.

The purpose and goals of StartEngine

StartEngine aims to democratize finance by giving everyone, regardless of their net worth or connections, the opportunity to invest in startups and high-growth companies. The platform provides entrepreneurs with a way to secure the necessary capital to bring their ideas to life, while also offering investors the potential for high returns and the chance to support innovative businesses.

StartEngine's role in financing startups

StartEngine plays a crucial role in the financing of startups by bridging the gap between entrepreneurs and investors. Through its user-friendly platform, entrepreneurs can create a compelling pitch and raise funds from a pool of interested investors. StartEngine provides the infrastructure, compliance expertise, and marketing resources to help startups reach their fundraising goals.

Why invest in StartEngine?

Benefits of investing in StartEngine

Investing in StartEngine offers several benefits for both experienced investors and those new to the world of crowdfunding. Firstly, StartEngine provides access to a wide range of investment opportunities that would typically only be available to venture capitalists and experienced angel investors. By investing through StartEngine, you have the chance to support innovative startups and potentially participate in their growth.

In addition, StartEngine allows for smaller investment amounts, making it more accessible and inclusive. This lower barrier to entry enables individuals to diversify their investment portfolio and spread their risk across multiple startups. Furthermore, StartEngine offers a user-friendly platform that simplifies the investment process, making it easy for anyone to navigate and explore potential opportunities.

Potential returns on investment

Investing in startups through StartEngine can offer the potential for significant returns. While investing in early-stage companies carries inherent risks, successful startups have the potential to experience exponential growth and provide investors with impressive returns on their investment. StartEngine provides investors with the opportunity to participate in this growth and potentially generate substantial profits if the startups they invest in succeed.

It's important to note that investing in startups is inherently risky, and not all investments will result in significant returns. However, by diversifying your investments and carefully selecting promising startups, you can increase your chances of achieving favorable returns.

Opportunities for diversification

One of the most appealing aspects of investing through StartEngine is the opportunity for diversification. StartEngine offers a wide range of investment options across various industries and sectors, allowing investors to spread their investments across multiple startups. By diversifying your portfolio, you reduce the risk associated with investing in a single company.

StartEngine's diverse selection of investment opportunities enables investors to support startups in industries they believe in, such as technology, health care, renewable energy, and consumer products. This versatility allows investors to align their investments with their personal interests and values, while also minimizing risk through diversification.

How does StartEngine work?

The process of investing through StartEngine

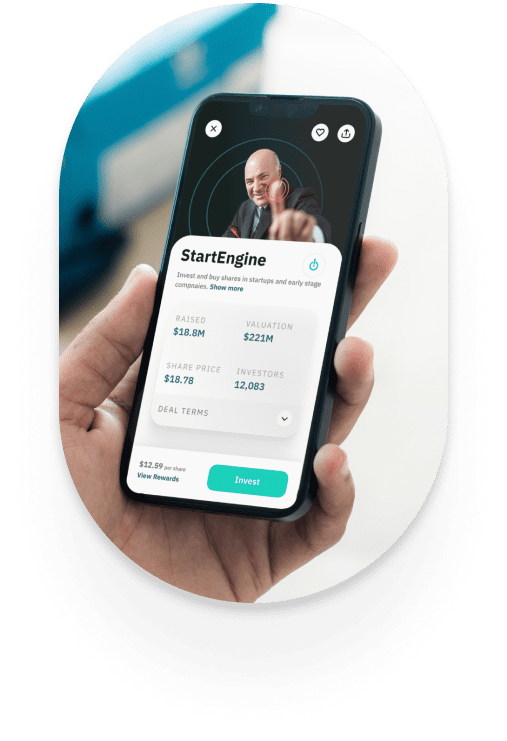

Investing through StartEngine is a straightforward process that can be completed in a few simple steps. First, you need to create an account on the StartEngine platform. This involves providing your personal information, such as your name, email address, and contact details.

Once you have created an account, you can explore the various investment opportunities available on StartEngine. StartEngine provides detailed information about each company, including their business model, financial projections, and the potential risks associated with the investment. It's essential to thoroughly research and evaluate each opportunity before making an investment decision.

After selecting a startup to invest in, you can choose the amount you wish to invest. StartEngine typically sets a minimum investment amount, which can be as low as $100. Once you have entered the investment amount, you will be prompted to review and sign the necessary legal documents. These documents outline the terms and conditions of the investment.

Creating an account on StartEngine

To create an account on StartEngine, you need to visit the StartEngine website and click on the “Sign Up” button. You will be prompted to provide your name, email address, and a password to create your account. Once you have completed the registration process, you will receive a confirmation email with a link to verify your account.

Exploring investment opportunities

StartEngine provides a user-friendly interface that allows you to explore and evaluate investment opportunities. The platform provides detailed information about each company, including their business model, industry, team, and financial performance. You can also view the percentage of equity offered in each investment, enabling you to assess the potential return on investment.

StartEngine also provides access to the company's offering circular, which contains further details about the investment opportunity. This document includes information about the company's financials, risks, and use of funds. It's essential to review the offering circular carefully and consult with financial professionals if needed before making an investment.

StartEngine's success stories

Highlighting successful startups funded through StartEngine

StartEngine has been instrumental in the success of numerous startups that have raised capital through the platform. Some notable success stories include EVELO, a leading electric bicycle company that raised over $6 million on StartEngine, and DroneDeploy, a provider of drone software that raised $20 million.

These success stories highlight the potential for startups to achieve significant growth and success with the help of StartEngine. By providing access to capital, StartEngine empowers ambitious entrepreneurs to turn their innovative ideas into reality and fuel economic growth.

The impact of StartEngine on these startups' growth

StartEngine's investment has had a significant impact on the growth of the startups it has funded. The capital raised on StartEngine has allowed these companies to expand their operations, develop new products, and scale their businesses. In many cases, the funding received through StartEngine has been a catalyst for these startups to attract further investment from venture capitalists and other institutions.

Moreover, StartEngine goes beyond providing funding to startups. The platform also offers marketing support, strategic guidance, and access to a network of investors and industry experts. This comprehensive support system further contributes to the growth and success of the startups raising funds through StartEngine.

Lessons learned from StartEngine's success stories

The success stories of startups funded through StartEngine provide valuable lessons for both entrepreneurs and investors. Firstly, these success stories demonstrate the importance of a compelling business idea and a strong execution plan. Startups that have successfully raised capital on StartEngine have had a clear vision for their businesses and a solid strategy for achieving their goals.

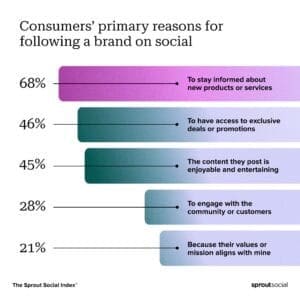

Additionally, the success stories highlight the significance of effective marketing and communication. Startups that have effectively communicated their value proposition and connected with the investor community have been more successful in attracting capital. Building a strong brand and engaging with potential investors are crucial aspects of a successful crowdfunding campaign.

StartEngine's investment options

Overview of different investment options available on StartEngine

StartEngine offers a variety of investment options to cater to different investor preferences and risk tolerances. The platform provides equity crowdfunding opportunities, allowing investors to purchase shares in early-stage companies. Investors can also participate in revenue-sharing agreements, where they receive a percentage of the company's revenues for a specified period.

In addition to equity and revenue-sharing investments, StartEngine offers convertible notes, which allow investors to loan money to startups with the option to convert the loan into equity at a future date. These investment options provide flexibility and cater to different investment strategies and objectives.

Types of companies and industries to invest in

StartEngine offers investment opportunities across various industries and sectors. Some popular sectors include technology, blockchain, real estate, health care, and consumer goods. Within these sectors, investors can choose from a wide range of companies, each with its unique value proposition and growth potential.

When considering investment options on StartEngine, it's essential to assess the company's industry dynamics, market potential, and competitive advantages. Evaluating the feasibility of the company's business model and the scalability of its product or service is crucial in making informed investment decisions.

Understanding the risk factors associated with each option

Investing in startups inherently carries a level of risk. StartEngine provides comprehensive information about the potential risks associated with each investment opportunity to help investors make informed decisions. The offering circulars for each startup outline the specific risks relevant to that company, including market competition, regulatory challenges, and the potential for product failure.

Before making an investment, it's important to assess your risk tolerance and carefully evaluate the risks associated with each investment opportunity. While StartEngine strives to vet the companies listed on its platform, it's crucial for investors to conduct their due diligence and seek advice from financial professionals if needed.

Key considerations before investing

Assessing your financial goals and risk tolerance

Before investing in StartEngine, it's important to assess your financial goals and risk tolerance. Consider your investment objectives, time horizon, and the amount of risk you are comfortable with. StartEngine offers opportunities for both short-term and long-term investments, so it's crucial to align your investment strategy with your financial goals.

Understanding your risk tolerance is equally important. Investing in startups carries inherent risks, as not all startups will succeed. Assess your ability to withstand potential losses and think long-term when it comes to your investment goals.

Researching and evaluating potential investment opportunities

Conducting thorough research and due diligence is crucial before making any investment. StartEngine provides detailed information about each investment opportunity on its platform, such as the company's business model, financial projections, and risks. Take the time to review this information, analyze the company's industry and market potential, and assess the viability of its product or service.

It's also helpful to research the founders and leadership team behind the startup. Evaluating their experience, track record, and vision can provide valuable insights into the startup's potential for success. Consider reaching out to the founders or attending webinars and events hosted by StartEngine to learn more about the investment opportunities.

Setting realistic expectations for investment returns

Investing in startups can be exciting, but it's crucial to set realistic expectations for investment returns. While some startups may experience significant growth and generate substantial returns, others may not succeed or take longer to generate profits. Avoid making investment decisions based solely on the potential for high returns and instead focus on the fundamentals of the investment opportunity.

It's also important to diversify your investments and spread your risk across multiple startups. This approach helps mitigate the impact of any potential losses and increases the likelihood of achieving favorable investment returns.

Investing strategies on StartEngine

Diversification strategies to minimize risk

Diversification is a key strategy used by investors to minimize risk. By spreading investments across multiple startups and industries, investors reduce their exposure to any single investment. StartEngine provides a wide range of investment opportunities, enabling investors to create a well-diversified portfolio.

When diversifying your investments, consider allocating your capital across different sectors, stages of growth, and types of investments. This approach helps protect your investments from industry-specific risks and increases the potential for positive returns.

Long-term vs. short-term investment approaches

Investors on StartEngine have the flexibility to adopt both long-term and short-term investment approaches. Some investors choose to support startups for the long haul, believing in the company's potential for substantial growth over time. These investors are willing to hold their investments for an extended period, allowing the startup to execute its business plan and deliver on its promises.

On the other hand, short-term investors may choose to participate in specific investment opportunities with a shorter time horizon. These investors may seek to take advantage of a particular market trend, exit the investment once they have achieved a specific return, or allocate their capital to other investment opportunities.

Strategies for maximizing investment growth

To maximize investment growth on StartEngine, it's important to stay updated with market trends and industry news. By staying informed, you can identify emerging trends and invest in startups that are well-positioned to capitalize on these trends. StartEngine provides regular updates and insights about its listed companies, enabling investors to stay informed about their portfolio investments.

Networking and collaborating with other investors can also be beneficial. Engaging with the StartEngine community allows you to exchange ideas, gain insights, and access valuable resources. Building relationships with other investors can foster a sense of camaraderie and provide opportunities for collaboration and knowledge-sharing.

Seeking advice from financial professionals is another strategy for maximizing investment growth. Financial advisors and consultants with experience in startup investing can provide guidance on investment strategies, risk management, and portfolio optimization. Their expertise can help you make informed investment decisions and navigate the complexities of startup investing.

Tips for successful investing on StartEngine

Staying updated with market trends and industry news

To be a successful investor on StartEngine, it's essential to stay updated with market trends and industry news. This knowledge allows you to identify emerging opportunities and make informed investment decisions. Follow industry publications, attend webinars and conferences, and leverage StartEngine's resources to stay informed about the latest developments in your areas of interest.

Networking and collaborating with other investors

Networking and collaborating with other investors can provide valuable insights and opportunities for collaboration. Engage with the StartEngine community, participate in discussions, and attend networking events to build connections with like-minded individuals. Sharing experiences and knowledge with others can help you expand your investment horizons and make better-informed decisions.

Seeking advice from financial professionals

Seeking advice from financial professionals can provide valuable guidance when investing on StartEngine. Financial advisors and consultants specializing in startup investing can help you assess risks, select promising investment opportunities, and optimize your investment strategy. Their expertise and experience can help you navigate the complexities of startup investing and increase your chances of success.

Legal and regulatory aspects

Understanding the legal requirements for investing on StartEngine

When investing on StartEngine, it's important to understand the legal requirements and regulations. StartEngine operates under the framework of Regulation Crowdfunding (Reg CF), which sets forth rules and limitations for crowdfunding investments. These regulations are aimed at protecting investors and ensuring transparency in the crowdfunding process.

Under Reg CF, there are limitations on the amount an individual can invest in a 12-month period based on their annual income or net worth. It's crucial for investors to understand and comply with these limitations to avoid any legal implications.

Complying with SEC regulations and guidelines

StartEngine adheres to the regulations set forth by the Securities and Exchange Commission (SEC) to ensure that investments on its platform comply with the necessary legal requirements. The SEC oversees the crowdfunding industry and enforces regulations to protect investors from fraudulent investment schemes.

As an investor, it's important to familiarize yourself with the SEC regulations and guidelines surrounding crowdfunding investments. Make sure to read and understand the offering circulars, as they provide detailed information about the investment opportunity and the associated risks. If you have any doubts or questions, consult with legal professionals or financial advisors experienced in crowdfunding investments.

Responsibilities of investors to protect their interests

Investors have a responsibility to protect their own interests when investing on StartEngine. This includes conducting thorough research, assessing the risks involved, and making informed investment decisions. It's important to diversify your investments, set realistic expectations, and carefully evaluate each investment opportunity based on your financial goals and risk tolerance.

Investors should also monitor their investment portfolio regularly and make adjustments as needed. StartEngine provides tools and resources to track your investments and evaluate their performance. Stay informed about the startups you have invested in, review their progress reports, and assess any changes in their business outlook.

Risks and challenges associated with StartEngine

Potential risks of investing in startups through StartEngine

Investing in startups through StartEngine carries certain risks that investors should consider. Startups are inherently risky and have a high failure rate. It's crucial to understand that not all startups will succeed, and there is a possibility of losing your investment.

Additionally, the valuation of startups can be challenging, as they often lack a track record of revenues and profits. Valuations are based on future expectations, which can be highly speculative. This uncertainty in valuation can pose risks to investors, as the startup's actual performance may differ significantly from projected figures.

Market volatility and its impact on investment value

StartEngine investments can be affected by market volatility, which can impact the value of your investments. Economic downturns, changes in market trends, and industry-specific challenges can all contribute to fluctuations in the value of startup investments. It's crucial to consider the potential impact of market volatility on your investment strategy and have a long-term perspective when investing in startups.

Challenges in identifying viable investment opportunities

Identifying viable investment opportunities can be a challenge, as not all startups listed on StartEngine will succeed. Assessing the viability of the business model, the market potential, and the capabilities of the founding team requires thorough research and analysis. It's important to carefully review the information provided by the startups on StartEngine and consult with financial professionals if needed.

To mitigate this risk, diversify your investment portfolio and spread your investments across multiple startups. By doing so, you increase your chances of investing in successful companies and reduce the impact of potential losses.

StartEngine vs. other investment platforms

Comparing StartEngine with similar crowdfunding platforms

StartEngine is one of the leading crowdfunding platforms, but there are several other platforms that offer similar investment opportunities. Some notable crowdfunding platforms include Kickstarter, Indiegogo, and SeedInvest. While these platforms may share similarities, there are key differences to consider.

StartEngine differentiates itself by focusing on equity crowdfunding and revenue-sharing agreements, providing investors with the opportunity to participate in the potential upside of the companies they invest in. StartEngine also offers a diverse range of investment opportunities, spanning multiple industries and sectors.

Differentiating factors that make StartEngine unique

What sets StartEngine apart from other crowdfunding platforms is its commitment to democratizing finance and providing access to investment opportunities for everyone. StartEngine is open to both accredited and non-accredited investors, making startup investing more inclusive and accessible. By lowering the barrier to entry, StartEngine allows individuals of all income levels to participate in the potential growth of startups.

Another unique aspect of StartEngine is its comprehensive support system for startups. Beyond just providing a fundraising platform, StartEngine offers marketing assistance, strategic guidance, and access to a network of investors and industry experts. This holistic approach increases the chances of success for startups raising funds on StartEngine.

Pros and cons of choosing StartEngine for investments

StartEngine has several advantages that make it an attractive option for investors. The platform offers a wide range of investment opportunities, making it easy to find startups in industries that align with your interests and values. The accessible investment amounts and user-friendly platform make it easy for anyone to start investing in startups.

However, there are also limitations to consider when investing through StartEngine. As with any startup investment, there is a high risk of failure, and not all startups will succeed. StartEngine's success rate is dependent on the startups listed on its platform, which can vary in terms of their growth potential and success rates.

Success factors for investing in startups

Key factors to consider when selecting startups for investment

When selecting startups for investment, several key factors can contribute to their potential for success. Firstly, consider the startup's business model and its alignment with industry trends. Startups that offer innovative solutions to existing problems or tap into emerging market opportunities have a higher likelihood of success.

The leadership and vision of startup founders also play a crucial role in their success. Assess the experience and track record of the founding team, their ability to execute the business plan, and their passion for the idea. Strong leadership and a clear vision are indicators of a startup's potential to overcome challenges and achieve growth.

Assessing the viability of the startup's product or service

Evaluating the viability of a startup's product or service is crucial when considering an investment opportunity. Assess the market potential for the product or service, the competitive landscape, and the startup's unique selling proposition. Look for startups that have a clear value proposition and a compelling market opportunity.

It may be helpful to seek feedback from potential customers or industry experts to validate the startup's product or service. Customer validation and market demand are key indicators of the viability and scalability of a startup's business model.

Building a diversified portfolio on StartEngine

Strategies for creating a diverse investment portfolio on StartEngine

Creating a diversified investment portfolio on StartEngine involves allocating your investments across multiple startups and industries. This strategy helps mitigate risk by spreading investments across different sectors and reducing exposure to any single investment.

StartEngine offers a diverse range of investment opportunities across various industries and sectors. Consider investing in startups from different sectors such as technology, health care, renewable energy, and consumer products. Allocating your investments across startups at different stages of growth can also help diversify your portfolio and manage risk.

Allocating investments across various industries and stages of growth

When building a diversified portfolio on StartEngine, it's important to allocate investments across various industries and stages of growth. Invest in startups in industries that you believe have immense growth potential and align with your interests. By diversifying across industries, you reduce the impact of industry-specific risks on your portfolio.

Investing in startups at various stages of growth is also beneficial. Startups in different stages of growth offer different levels of risk and return potential. Consider investing in a mix of early-stage startups with high growth potential and more mature startups that have demonstrated traction and revenue.

Monitoring and rebalancing the portfolio for optimal performance

Regularly monitoring and rebalancing your portfolio is essential for optimal performance. Keep track of the startups you have invested in, assess their progress reports, and evaluate any changes in their business outlook. Regularly review your investment strategy, adjust your allocations if needed, and make informed decisions based on market trends and industry developments.

As your investment portfolio grows, rebalancing becomes increasingly important to maintain your desired level of risk and return. Reassess your risk tolerance, financial goals, and investment timeline periodically to ensure that your portfolio remains aligned with your evolving needs.

Conclusion

The potential of StartEngine as an investment platform

StartEngine offers individuals the opportunity to invest in startups and high-growth companies, democratizing finance and allowing people of various income levels to participate in the potential rewards of startup investing. The platform provides a user-friendly interface, a diverse range of investment opportunities, and a comprehensive support system for startups.

With the potential for significant returns and opportunities for diversification, StartEngine has become a popular choice for investors looking to support innovative businesses. However, investing in startups inherently carries risks, and careful consideration should be given to each investment opportunity.

Key takeaways for aspiring investors

When considering investing in startups through StartEngine, it's important to:

- Assess your financial goals and risk tolerance before making investment decisions.

- Research and evaluate potential investment opportunities thoroughly.

- Set realistic expectations for investment returns and diversify your portfolio.

- Stay updated with market trends and seek advice from financial professionals.

- Understand the legal requirements and regulations governing crowdfunding investments.

By following these key principles, aspiring investors can navigate the world of startup investing and maximize their chances of success.

Encouragement to explore StartEngine's opportunities

Investing in startups through StartEngine can be an exciting and potentially rewarding experience. The platform provides access to a diverse array of investment opportunities, allowing individuals to support innovative businesses and potentially generate significant returns.

By embracing the principles of informed decision-making, diversification, and long-term thinking, investors can leverage StartEngine as a powerful platform for fueling their financial growth and supporting the next generation of entrepreneurial talent.

So why wait? Explore StartEngine's investment opportunities today and embark on your journey to support innovative startups and diversify your investment portfolio.