If you find yourself in a tough spot financially, fret not, because there are still loan options available for individuals with poor credit. In this article, we will take a closer look at some of the top loan options specifically designed to help those with bad credit. Whether you need a personal loan, a secured loan, or even a payday loan, rest assured that there are lenders out there ready to assist you in getting the financial support you need. Let's explore these top loan options so you can regain control of your financial situation with confidence.

This image is property of images.ctfassets.net.

1. Personal Loans

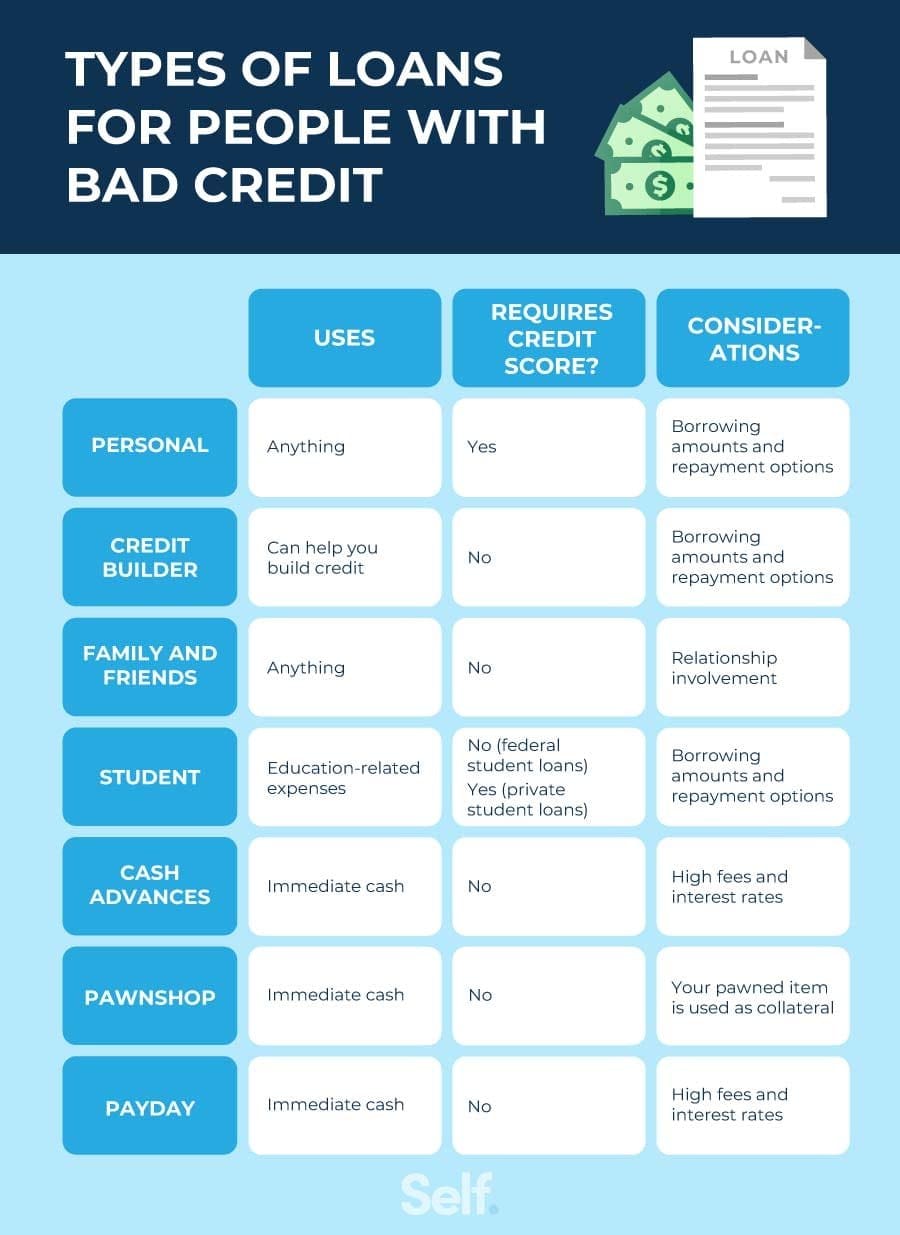

When you're in need of extra money, a personal loan can be a great option. Personal loans are typically installment loans that allow you to borrow a fixed amount of money and repay it over a set period of time. There are several types of personal loans available, each with its own features and requirements.

1.1 Secured Personal Loans

Secured personal loans are loans that require collateral, such as a car or a house, to secure the loan. By using collateral, lenders have a way to recoup their losses if the borrower defaults on the loan. Secured personal loans often have lower interest rates and higher borrowing limits compared to unsecured personal loans, making them a popular choice for individuals with poor credit.

1.2 Unsecured Personal Loans

Unsecured personal loans are loans that don't require collateral. Instead, lenders rely on the borrower's creditworthiness to determine if they will approve the loan. Unsecured personal loans usually have higher interest rates and lower borrowing limits than secured personal loans, but they are still a viable option for individuals with poor credit.

1.3 Payday Loans

Payday loans are short-term loans that are typically due on your next payday. These loans are designed to provide quick cash to cover unexpected expenses. Payday loans are easy to qualify for, even with poor credit, but they come with high interest rates and fees. It's important to use payday loans responsibly and only when absolutely necessary, as they can quickly lead to a cycle of debt if not managed properly.

2. Credit Union Loans

Credit unions are not-for-profit financial institutions that offer a variety of loan options to their members. They often have more flexible lending criteria and lower interest rates compared to traditional banks. If you have poor credit, credit union loans may be a good option to explore.

2.1 Savings-Secured Loans

Savings-secured loans are loans that are secured by funds in your savings account or share certificate. By using your own money as collateral, you can secure a loan even with poor credit. Savings-secured loans offer lower interest rates and can be a great way to rebuild your credit history.

2.2 Co-Signer Loans

If you have a family member or friend with good credit, they may be willing to co-sign a loan for you. A co-signer loan involves someone else taking responsibility for the loan if you fail to make payments. With a co-signer, you may be able to qualify for a loan with more favorable terms and lower interest rates.

2.3 Peer-to-Peer Lending

Peer-to-peer lending, also known as P2P lending, is a form of lending that connects borrowers directly with individual lenders. This online platform eliminates the need for a traditional financial institution, making it possible to borrow money even with poor credit. Peer-to-peer lending often has competitive interest rates and flexible repayment terms.

This image is property of www.loantube.com.

3. Online Lenders

Online lenders have become increasingly popular in recent years, providing borrowers with quick and convenient access to funds. These lenders often specialize in providing loans to individuals with poor credit and offer a variety of loan options.

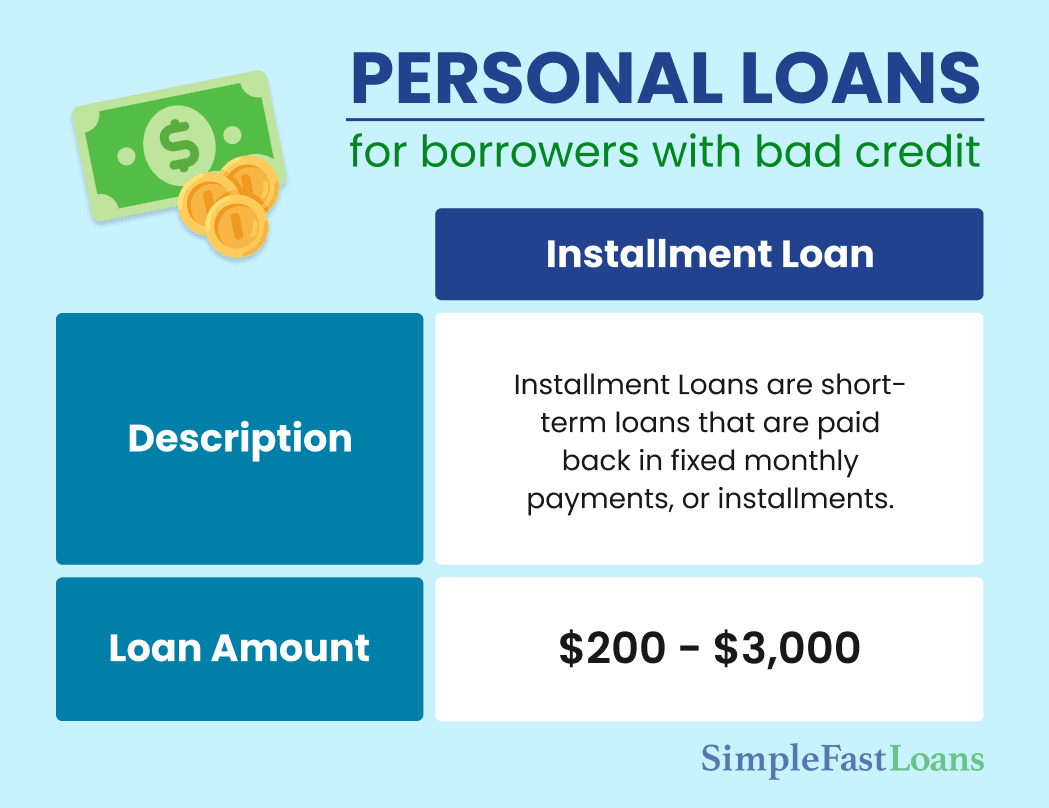

3.1 Installment Loans

Installment loans are loans that are repaid in regular fixed payments over a set period of time. Online lenders offer installment loans, even for individuals with poor credit. These loans often have higher interest rates, but they provide you with the opportunity to rebuild your credit history through consistent on-time payments.

3.2 Payday Alternative Loans (PALs)

Payday Alternative Loans (PALs) are small-dollar loans offered by credit unions as an alternative to traditional payday loans. PALs have lower interest rates and longer repayment terms compared to payday loans, making them a more affordable option for individuals with poor credit.

3.3 Direct Lenders

Direct lenders are online lenders that provide loans directly to borrowers without involving any intermediaries. These lenders often specialize in working with individuals who have poor credit, offering flexible loan terms and quick approval processes. Direct lenders can be a convenient and accessible option for individuals with bad credit.

4. Home Equity Loans

If you own a home, you may be able to tap into your home's equity to secure additional funds. Home equity loans allow you to borrow against the value of your home and use the money for any purpose.

4.1 Cash-Out Refinance

Cash-out refinance involves refinancing your existing mortgage for a higher amount than you currently owe and receiving the difference in cash. This can be a useful option for homeowners with poor credit who need a large sum of money.

4.2 Home Equity Line of Credit (HELOC)

A home equity line of credit, or HELOC, is a line of credit that allows you to borrow against the equity in your home on an as-needed basis. HELOCs often have variable interest rates and provide flexibility in accessing funds over a period of time. This can be a suitable option for individuals with poor credit who may need funds for various expenses over time.

This image is property of 24data-strapi-uploads.s3.amazonaws.com.

5. Credit Card Cash Advances

Credit card cash advances allow you to borrow cash against your credit card's available balance. While this can be a quick and convenient option, it's important to note that credit card cash advances often come with high interest rates and fees. It's crucial to use this option responsibly and only when necessary.

6. Family and Friends

In some cases, borrowing money from family or friends can be a viable option. It's important to approach this option with caution and ensure clear communication and documentation to avoid any strain on your relationship. Agreeing on repayment terms and treating the loan as a formal agreement can help maintain a healthy dynamic.

This image is property of www.takemetothesite.com.

7. Government Assistance Programs

Government assistance programs can provide financial support to individuals with specific needs or circumstances. These programs often have specific eligibility criteria and requirements.

7.1 Title I Property Improvement Loans

Title I Property Improvement Loans are loans provided by government-approved lenders to help homeowners make necessary improvements or repairs to their homes. These loans are insured by the Federal Housing Administration (FHA) and can be an option for individuals with poor credit who need to fund home improvements.

7.2 VA Home Loans

VA Home Loans are loans available to veterans, active-duty military personnel, and eligible surviving spouses. These loans are guaranteed by the Department of Veterans Affairs (VA) and often have more flexible requirements and favorable terms, making them accessible to individuals with poor credit who have served in the military.

7.3 USDA Rural Development Home Loans

USDA Rural Development Home Loans are loans provided by the United States Department of Agriculture (USDA) for individuals looking to purchase or repair homes in rural areas. These loans often have lower down payment requirements and more flexible credit guidelines, making them an option for individuals with poor credit who want to live in rural communities.

8. Payday Alternative Loans (PALs)

Payday Alternative Loans (PALs) were previously mentioned as an option provided by credit unions. These loans are designed to provide short-term financial assistance to individuals with poor credit. PALs often have lower interest rates and longer repayment terms compared to traditional payday loans.

This image is property of images.ctfassets.net.

9. Online Installment Loans

Online installment loans, previously mentioned in the online lenders section, are installment loans that can be accessed through online lenders. These loans provide individuals with poor credit the opportunity to borrow larger sums of money than payday loans, with a structured repayment plan.

10. Cash Advances with Pawnbrokers

Another option for individuals with poor credit is obtaining a cash advance from a pawnbroker. A pawnbroker lends money against the value of an item that you provide as collateral. These loans typically have shorter terms and higher interest rates, but they can offer a quick solution if you have an item of value that you're willing to use as collateral.

In conclusion, there are various loan options available for individuals with poor credit. From personal loans to government assistance programs, it's important to evaluate each option carefully and choose the one that best fits your financial needs and circumstances. Remember to consider the terms, interest rates, and repayment plans of each loan to make an informed decision. Additionally, always borrow responsibly and ensure that you have a plan in place to repay the loan on time to avoid further financial difficulties.