Securing personal loans can feel daunting, especially for individuals with bad credit. But fear not, as we are here to guide you through the process and help you find the perfect loan option for your needs. In this article, we will explore the world of secured personal loans, shedding light on how they can be accessed even with low credit scores. Whether you're looking to consolidate debts, cover unexpected expenses, or finance a major purchase, we've got you covered with tips and advice on how to navigate the loan application process wisely, ensuring you secure a loan that suits your financial situation while keeping interest rates as low as possible.

Securing Personal Loans With Bad Credit

Understanding Secured Personal Loans

Definition of secured personal loans

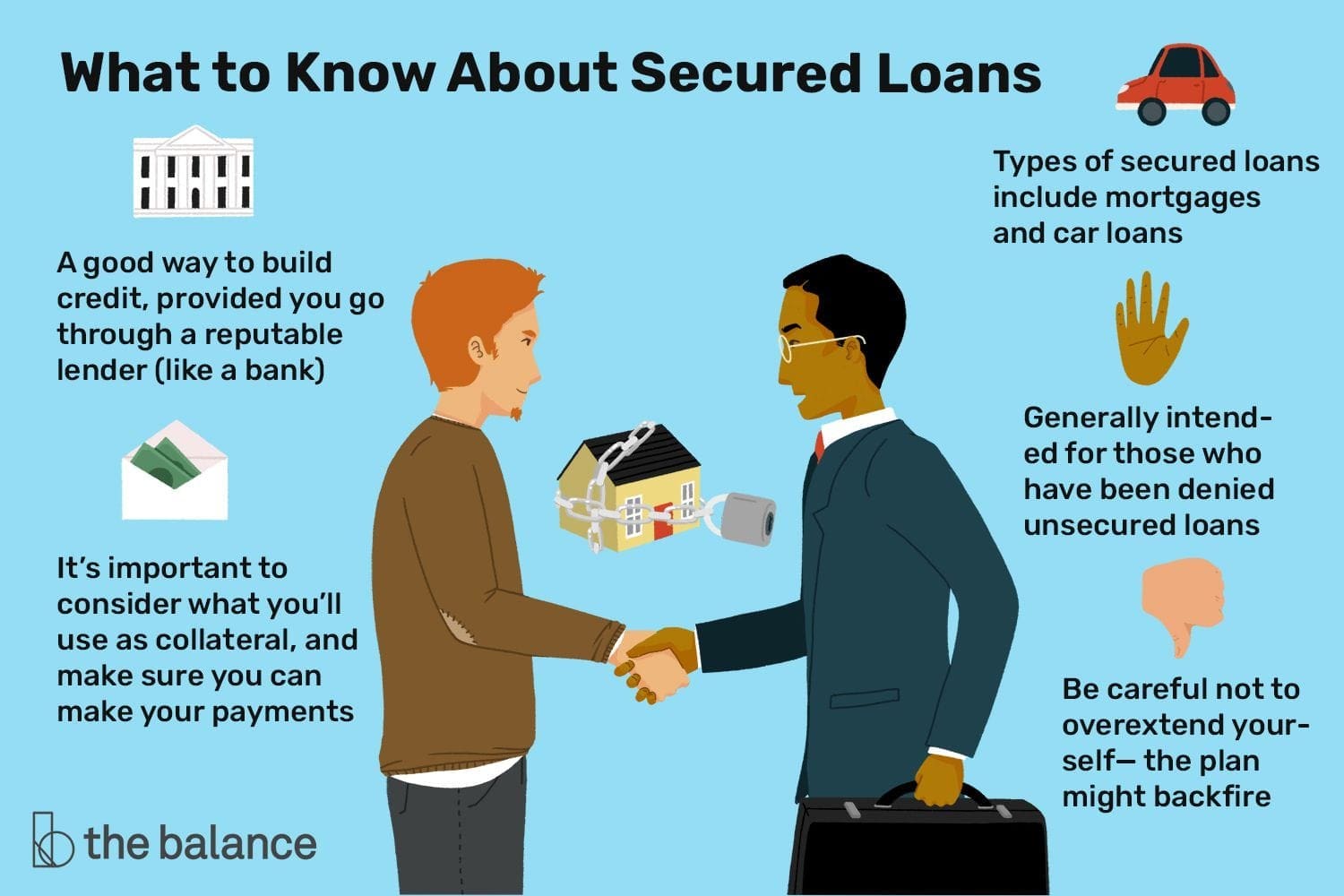

Secured personal loans are a type of loan that requires the borrower to provide collateral as a form of security for the lender. Collateral can be any valuable asset like a car, property, or savings account. This collateral serves as a guarantee that the lender can recoup their losses if the borrower fails to repay the loan.

Benefits of secured personal loans

One of the major benefits of secured personal loans is that they offer lower interest rates compared to unsecured loans. This is due to the reduced risk for the lender since they have the collateral to fall back on in case of default. Additionally, secured personal loans can be a valuable tool for individuals with bad credit, as the collateral provides reassurance to lenders and increases the chances of loan approval.

Difference between secured and unsecured personal loans

The key difference between secured and unsecured personal loans lies in the presence or absence of collateral. Secured loans require collateral, while unsecured loans do not. Unsecured loans are typically offered to individuals with good credit histories and high credit scores, as they rely solely on the borrower's promise to repay. On the other hand, secured loans are accessible to individuals with bad credit and provide an opportunity for them to rebuild their credit by making timely loan payments.

Assessing Your Financial Situation

Evaluating your credit score

Before applying for a secured personal loan, it is essential to evaluate your credit score. A credit score is a numerical representation of your creditworthiness and plays a critical role in loan approval and determining interest rates. You can obtain a credit report from major credit bureaus and review it for any errors or discrepancies. Improving your credit score by paying bills on time and reducing debt can increase your chances of securing a loan with favorable terms.

Calculating your debt-to-income ratio

Another important factor to consider when assessing your financial situation is your debt-to-income (DTI) ratio. DTI ratio is calculated by dividing your monthly debt payments by your monthly income. Lenders often use this ratio to evaluate your ability to repay a loan. A lower DTI ratio signifies a lower risk for the lender. To calculate your DTI ratio, add up all your monthly debt payments and divide the sum by your monthly income. Aim for a DTI ratio below 36% to demonstrate your financial stability to potential lenders.

Determining your loan affordability

Before committing to a loan, it is crucial to determine your loan affordability. Consider your monthly income, expenses, and financial responsibilities. Create a budget that accounts for loan payments and assess whether you can comfortably manage the additional financial obligation. Taking into account your existing debts and other financial commitments is essential to avoid any future financial strain. Analyzing your loan affordability ensures that you borrow within your means and reduces the risk of default.

This image is property of fastercapital.com.

Get Personal Loans With Bad Credit

Researching Lenders and Loan Options

Identifying lenders specializing in bad credit loans

When looking for a secured personal loan with bad credit, it is crucial to identify lenders who specialize or have experience in lending to individuals with poor credit histories. These lenders understand the challenges faced by borrowers with bad credit and are more likely to offer suitable loan options. Research online, speak to financial advisors, or reach out to local credit unions to find lenders with flexible eligibility criteria and competitive interest rates for secured personal loans.

Understanding loan terms and interest rates

As you research lenders, it is crucial to understand the loan terms and interest rates associated with secured personal loans. Loan terms refer to the length of time you have to repay the loan, while interest rates determine the cost of borrowing. Compare the terms and rates offered by different lenders to find the most favorable loan option. Pay attention to factors such as the repayment period, prepayment penalties, and any additional fees. Having a clear understanding of loan terms and interest rates will help you make an informed decision.

Comparing different loan options

Once you have identified potential lenders, compare their loan options to find the best fit for your needs. Look beyond the interest rates and loan terms and consider factors such as customer service, reputation, and flexibility of repayment options. Reading customer reviews and seeking recommendations can provide valuable insights into the experiences of past borrowers. Taking the time to compare different loan options ensures that you make an informed decision and choose the lender that aligns with your financial goals.

Preparing Necessary Documentation

Gathering proof of income and employment

To demonstrate your ability to repay the loan, you will need to gather proof of income and employment. This may include recent pay stubs, tax returns, or employment contracts. Lenders want to ensure that you have a stable and consistent source of income to meet your loan obligations. Providing accurate and up-to-date documentation will strengthen your loan application and increase your chances of approval.

Organizing financial statements and bank records

In addition to proof of income, you will need to organize your financial statements and bank records. These documents provide an overview of your financial stability and assist in assessing your ability to manage the loan. Gather bank statements, investment statements, and other pertinent financial records to present a comprehensive picture of your financial health. Organizing these documents before applying for a loan will streamline the application process and help lenders understand your financial situation better.

Documenting collateral for secured loans

As secured personal loans require collateral, it is essential to document the details of the collateral you are offering. This includes information such as property deeds, vehicle ownership documents, or savings account statements. Provide clear and accurate documentation that proves your ownership or control over the collateral. The lender will evaluate the value and marketability of the collateral to calculate the loan amount they are willing to extend. Ensuring proper documentation of collateral enhances the credibility of your loan application.

This image is property of fastercapital.com.

Bad Credit Personal Loans Guide

Building a Solid Loan Application

Explaining the reasons for bad credit

When faced with bad credit, it is essential to explain the reasons behind it in your loan application. Whether it was due to a period of financial hardship, medical expenses, or any other unforeseen circumstance, providing this context can help lenders understand your credit history more comprehensively. Be transparent and honest in your explanations, as it demonstrates your willingness to take responsibility for past financial struggles and provides insight into your current financial stability.

Highlighting positive aspects of your financial situation

While acknowledging your bad credit, do not forget to highlight the positive aspects of your financial situation. Emphasize any improvements you have made in managing your finances and showcase any reliable income sources or assets you possess. Lenders appreciate borrowers who take proactive steps to improve their financial health. By highlighting your positive financial aspects, you demonstrate your commitment to responsible borrowing and increase your chances of loan approval.

Providing a detailed repayment plan

To convince lenders of your ability to repay the loan, it is vital to present a detailed repayment plan. Outline your budget, including your monthly income, expenses, and loan payments. Show how you plan to allocate your finances to meet your loan obligations consistently. This gives lenders confidence in your financial planning skills and reassurance that you have considered the loan as a significant commitment. Providing a well-thought-out repayment plan portrays you as a responsible borrower and enhances the credibility of your loan application.

Securing Collateral for the Loan

Understanding acceptable collateral options

When securing collateral for a secured personal loan, it is crucial to understand which assets are acceptable to lenders. Common options for collateral include real estate, vehicles, savings accounts, or other valuable assets. These assets should have a certain level of value and marketability for lenders to consider them as viable collateral. Research and discuss with the lender to ensure that the collateral you intend to use aligns with their specific requirements.

Assessing the value of your collateral

Before submitting your loan application, it is advisable to assess the value of your collateral. The value of the collateral will impact the loan amount you can borrow and the interest rates offered. Consider obtaining professional appraisals or researching recent market values to evaluate the worth of your collateral accurately. Providing an accurate assessment of collateral value enhances transparency in the loan process and enables lenders to make well-informed decisions.

Applying appropriate insurance coverage

To protect your collateral and the lender's interest, it is important to apply appropriate insurance coverage. Lenders often require borrowers with secured personal loans to have insurance coverage that safeguards the collateral against damage, theft, or other risks. Discuss insurance requirements with your lender and make sure you have adequate coverage in place. With the right insurance, both you and the lender can have peace of mind knowing that the collateral is protected.

This image is property of www.nerdwallet.com.

Securing Personal Loans: A Guide for Individuals with Bad Credit

Finding a Suitable Co-Signer

Understanding the role of a co-signer

In some cases, finding a suitable co-signer can greatly improve your chances of obtaining a secured personal loan. A co-signer is someone who agrees to take equal responsibility for the loan if you fail to repay it. Their credit history and income stability provide an added layer of assurance for lenders. By having a co-signer, lenders may be more willing to approve the loan or offer better terms and interest rates.

Choosing a reliable and creditworthy co-signer

Finding a reliable and creditworthy co-signer is crucial when considering this option. A co-signer should have a good credit history, stable income, and a solid reputation regarding financial responsibility. It is important to choose someone who understands the implications of being a co-signer and is willing to fulfill their obligations if necessary. Openly discuss the responsibilities and potential risks with the co-signer before moving forward with the loan application.

Discussing responsibilities and risks with the co-signer

Before finalizing the loan application, have a thorough conversation with the prospective co-signer regarding their responsibilities and the risks involved. Ensure that they fully understand the implications of being a co-signer, including the potential impact on their credit and financial stability. Discuss the terms of the loan, including the repayment schedule, and establish clear communication channels to address any concerns or issues that may arise during the loan term. Open and honest communication is key to maintaining a healthy co-signer relationship.

Submitting Loan Applications

Completing the loan application accurately

When submitting your loan application, ensure that you complete it accurately and provide all the necessary information. Double-check your personal details, financial information, and loan requirements to avoid any mistakes or missing information. Providing incomplete or incorrect information can delay the application process or even lead to a rejection. Take the time to review the application thoroughly and make any necessary corrections before submission.

Including all necessary supporting documents

Along with the loan application, include all the necessary supporting documents requested by the lender. This may include your proof of income, bank statements, collateral documents, and any other documentation specified by the lender. Organize these documents in an easily understandable manner and ensure they are up to date. Submitting a complete and organized set of supporting documents not only speeds up the application process but also improves the chances of approval.

Being proactive in following up on the application

After submitting your loan application, it is essential to stay proactive and follow up on its progress. Contact the lender regularly to inquire about the status of your application and any additional requirements they may have. Being proactive in following up demonstrates your commitment and eagerness to secure the loan. It also allows you to address any concerns or provide any necessary information promptly.

This image is property of www.thebalancemoney.com.

Managing the Loan Repayment

Creating a budget and financial plan

Once you have received the loan, it is crucial to create a budget and financial plan to effectively manage the loan repayment. Take into account your monthly income, expenses, and loan payments. Set aside a portion of your income solely for loan repayment purposes. By creating a comprehensive budget and financial plan, you can ensure that you can meet your obligations and avoid any financial strain throughout the loan term.

Making timely loan payments

Timely loan payments are crucial to maintain a positive credit history and build your financial health. Set reminders or automate your payments to ensure they are made on time each month. Late or missed payments can have detrimental effects on your credit score and may lead to additional fees or penalties. Prioritize your loan payments and make them a financial priority to establish a track record of responsible borrowing and improve your credit over time.

Considering debt consolidation or refinancing options

If you have multiple debts or struggle to manage your loan payments, it may be beneficial to explore debt consolidation or refinancing options. Debt consolidation involves combining multiple debts into a single loan, simplifying your repayment process. Refinancing, on the other hand, involves replacing your current loan with a new loan that offers better terms and interest rates. Both options can help reduce financial stress and potentially lower your monthly payments. Assess your financial situation and consult with a financial advisor to determine if these options are suitable for you.

Improving Credit Score and Financial Health

Monitoring credit reports regularly

Improving your credit score requires vigilance and regular monitoring of your credit reports. Obtain copies of your credit reports from major credit bureaus and review them for any errors, inaccuracies, or fraudulent activities. Dispute any incorrect information and follow up to ensure it is corrected. Regularly monitoring your credit reports allows you to track your progress, identify areas for improvement, and protect your creditworthiness.

Paying bills on time and reducing debt

One of the most effective ways to improve your credit score and overall financial health is by consistently paying your bills on time and reducing your debt. Set up automatic payments or create reminders to ensure that all your bills are paid promptly. Additionally, focus on reducing your debt by allocating extra funds towards loan payments or implementing a debt repayment strategy. By demonstrating responsible financial behavior, you can gradually improve your credit score and establish a solid foundation for improved financial health.

Seeking professional financial guidance

If you are struggling to manage your finances, it may be beneficial to seek professional financial guidance. Financial advisors or credit counseling organizations can provide expert advice tailored to your specific situation. They can help you create a personalized financial plan, offer strategies for debt management, and provide guidance on improving your credit. Seeking professional assistance can empower you to make sound financial decisions and attain long-term financial stability.

In conclusion, securing a personal loan with bad credit may pose challenges, but it is not an impossible task. By understanding secured personal loans, assessing your financial situation, researching lenders and loan options, preparing necessary documentation, building a solid loan application, and managing the loan repayment responsibly, you can navigate the process with confidence. Remember to focus on improving your credit score and financial health to establish a stronger financial foundation for the future. Seek professional guidance when needed and remain proactive throughout the loan journey. With determination and proper planning, you can successfully secure a secured personal loan and work towards achieving your financial goals.

Securing Personal Loans: A Guide for Individuals with Bad Credit