These objectives act as our road map, assisting us in navigating the challenges of our undertakings. A framework that not only inspires us but also enables us to efficiently gauge our progress is created by setting attainable goals.

Key Takeaways

- Setting realistic goals is important for the success of any project or business venture.

- Direct costs should be carefully identified and calculated to accurately budget for expenses.

- Budgeting for indirect costs is essential for a comprehensive financial plan.

- Estimating marketing and promotion expenses is crucial for reaching target audiences and driving sales.

- Factoring in platform fees and payment processing costs is necessary for accurate financial planning.

Setting reasonable objectives helps us stay clear of the dangers of overcommitting, which can result in dissatisfaction & burnout. Also, establishing reasonable objectives encourages accountability among team members. We can more effectively distribute our resources and give priority to tasks that support our goals when we all agree on what is achievable.

This mutual understanding fosters a cooperative atmosphere where all parties are working toward the same goal. The ability to overcome obstacles with resilience & confidence is ultimately provided by realistic goals, which help us stay focused on our vision while adjusting to shifting conditions. Recognizing the Value of Direct Costs. We can get a better idea of the financial requirements for success by precisely identifying these costs. We need to collect comprehensive data on every expense in order to compute direct costs efficiently.

Dissecting the components of the project. This entails dissecting our project into its constituent parts and giving each one a monetary value. For example, when launching a product, we must take into account the cost of packaging, production labor, and raw materials. developing a thorough budget.

| Expense Category | Cost |

|---|---|

| Production Costs | XXXX |

| Marketing and Advertising | XXXX |

| Rewards and Incentives | XXXX |

| Platform Fees | XXXX |

| Shipping and Fulfillment | XXXX |

| Contingency Fund | XXXX |

| Total Costs | XXXX |

By gathering this information, we can produce a thorough budget that accurately accounts for the project's expenses, enabling us to decide on pricing & resource allocation. Indirect costs can have a big influence on our overall budget, even though direct costs are crucial to our financial planning. The costs that are required for our business to run but are not directly related to a particular project are known as indirect costs. These could consist of office supplies, administrative pay, and utilities.

Budgeting for these indirect expenses guarantees that we have a comprehensive picture of our financial situation. We should examine past data and industry standards in order to properly budget for indirect costs. Because of this, we are able to precisely estimate these costs and include them in our overall budget.

We can also look into ways to reduce indirect costs through partnerships or efficiency enhancements. We can increase our financial stability & devote more funds to direct project costs by taking proactive measures to control these costs. In the current competitive environment, marketing and promotion are essential to any project's or business initiative's success. Estimating marketing & promotion costs becomes critical as we build our financial plan. Advertising campaigns, social media promotions, & public relations initiatives are all included in these expenses.

By precisely projecting these costs, we can make sure that we allot enough funds to successfully reach our target market. We should take into account a variety of channels & strategies that complement our objectives when estimating marketing expenditures. This could entail carrying out market research to determine the best channels for connecting with our target audience. We should also account for the expenses of creative development, like copywriting and graphic design.

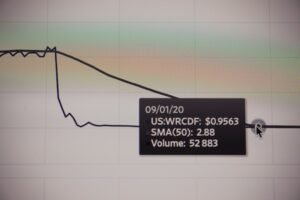

By estimating marketing costs thoroughly, we can make a budget that maximizes our return on investment and supports our promotional activities. Platform fees and payment processing expenses must be taken into account as we manage the project's budget. Whether we are using digital platforms to offer services or sell goods online, these fees can have a big effect on our bottom line.

We can choose where to do business with confidence if we are aware of the different fees connected to various platforms. Examining the fee schedules of the platforms we plan to use will help us appropriately account for these expenses. This covers transaction fees, subscription fees, and any other possible costs. We can prevent unpleasant financial surprises later on by factoring these costs into our budget up front.

Investigating different payment processing choices could also help us cut expenses and raise overall profitability. Realizing the Value of Taxes and Legal Fees. As part of our budgeting process, taxes & legal fees must be taken into account in any financial plan. Depending on our location, business structure, and industry regulations, these costs may differ substantially. We can guarantee compliance and steer clear of any legal pitfalls that might endanger our project by taking proactive measures to address these expenses.

To get accurate budgeting advice, consult an expert. Financial advisors or legal experts who specialize in our sector should be consulted in order to properly budget for taxes and legal fees. They can offer important information about tax responsibilities and possible deductions that might be relevant to our project. Also, we can confidently navigate complex regulatory environments by allocating funds expressly for legal consultations. keeping risks to a minimum and guaranteeing sustained success. We reduce risks and set ourselves up for long-term success by integrating these factors into our financial plan.

Fulfillment and shipping costs must be taken into consideration as we proceed with our financial planning, particularly if we are selling goods directly to customers. These expenses include everything from logistics of delivery to packaging and storage. We can make sure that our pricing strategy reflects the actual cost of bringing our products to market by precisely estimating these costs. We should examine different shipping options and the related costs in order to properly account for fulfillment and shipping expenses. This could entail negotiating prices with shipping companies or looking into fulfillment facilities that provide affordable prices.

Also, we can make well-informed decisions about how to organize our shipping strategy by taking into account elements like customer satisfaction and delivery times. Maintaining healthy profit margins and improving customer satisfaction are both possible with diligence in this area. The necessity of contingency funds—reserves set aside to handle unforeseen expenses or challenges that may arise during a project—should be carefully considered in any financial plan. As a safety net, contingency funds enable us to adjust to unanticipated events without causing our overall budget to falter.

The possible risks connected to our project should be evaluated in order to establish a suitable amount for contingency funds. Analyzing past data from related projects or speaking with industry professionals to gain understanding of typical problems encountered by companies in our sector may be necessary for this. By setting up a contingency fund that corresponds with our risk assessment, we can approach our project with more assurance, knowing that we have the means to deal with any unforeseen circumstances. Setting attainable goals is crucial for success, but it's also critical to take into account the effects of stretch goals, which are challenging objectives that force us to step outside of our comfort zones.

Stretch objectives can encourage creativity and push us to go beyond our first expectations. They do, however, have inherent risks that need to be carefully considered in the context of our financial plan. The possible benefits and difficulties of stretch goals should be taken into account when evaluating them.

Although reaching these lofty goals may present tremendous growth prospects, doing so might also necessitate extra funding or resources, which would put a strain on our budget. We can achieve a balance between aspiration & pragmatism by carefully examining the viability of stretch goals in light of our financial plan. Obtaining expert guidance and consultation can be extremely beneficial as we negotiate the intricacies of financial planning and budgeting. Our financial strategy can be better informed by the extensive knowledge and experience that accountants, financial advisors, & industry experts bring to the table.

Their advice can help us with risk management, investment strategies, and tax planning, among other things. By interacting with experts, we can access specialized knowledge that might be beyond our own area of expertise. Their advice can improve our overall financial savvy, whether it be in comprehending complex tax laws or creating an extensive investment strategy. Building connections with reliable advisors puts us in a successful position and guarantees that we have the tools necessary to overcome obstacles.

Finally, it's critical to review and modify our objectives as necessary as we carry out our financial plan. The business environment is ever-changing; things like market trends or unanticipated difficulties might call for adjustments to our goals or financial allotments. By periodically evaluating our goals and progress, we can stay flexible in the face of changing conditions. Finding areas where changes might be required, such as reallocating resources or improving strategies based on performance metrics, is made possible by establishing a routine for assessing our objectives. By using an iterative process, we can stay responsive to new opportunities or challenges that come up along the way while still staying in line with our overall vision.

In summary, everything from budgeting for direct & indirect expenses to establishing reasonable goals must be carefully taken into account when creating a thorough financial plan. When we approach financial planning holistically and maintain flexibility in the face of shifting conditions, we set ourselves up for long-term success in accomplishing our goals and negotiating the intricacies of the modern business world.

If you are interested in learning more about crowdfunding campaigns and how to ensure their success, you may want to check out the reviews section on BackersHub. One article that may be of interest is “The Top Crowdfunding Platforms of 2021,” which provides valuable insights into the best platforms to use for your campaign. Understanding the different platforms available can help you make an informed decision when setting your crowdfunding goals and calculating total costs.

FAQs

What is crowdfunding?

Crowdfunding is a method of raising capital through the collective effort of friends, family, customers, and individual investors. This approach taps into the collective efforts of a large pool of individuals—primarily online via social media and crowdfunding platforms—and leverages their networks for greater reach and exposure.

Why is it important to calculate total costs before setting crowdfunding campaign goals?

Calculating total costs before setting crowdfunding campaign goals is important because it helps ensure that the funding goal set is realistic and covers all expenses associated with the project or initiative. Failing to accurately calculate total costs can lead to underfunding and potential project failure.

What are the key components to consider when calculating total costs for a crowdfunding campaign?

Key components to consider when calculating total costs for a crowdfunding campaign include production costs, marketing and promotion expenses, fulfillment and shipping costs, platform fees, taxes, and contingency funds for unexpected expenses.

How can one calculate production costs for a crowdfunding campaign?

Production costs for a crowdfunding campaign can be calculated by estimating the cost of materials, manufacturing, labor, packaging, and any other expenses directly related to creating the product or delivering the service being offered through the campaign.

What are some common mistakes to avoid when calculating total costs for a crowdfunding campaign?

Common mistakes to avoid when calculating total costs for a crowdfunding campaign include underestimating production costs, overlooking marketing and promotion expenses, failing to account for fulfillment and shipping costs, and neglecting to include contingency funds for unexpected expenses.

Where can one find resources or tools to help with calculating total costs for a crowdfunding campaign?

There are various online resources and tools available to help with calculating total costs for a crowdfunding campaign, including crowdfunding platforms that provide calculators and templates, financial planning websites, and industry-specific resources and guides.