In the world of trading, the concept of a stop loss is fundamental to managing risk and protecting capital. A stop loss is essentially a predetermined price level at which I will exit a trade to prevent further losses. By setting a stop loss, I can limit my potential losses on a trade, allowing me to maintain control over my investment strategy.

This tool acts as a safety net, ensuring that I do not hold onto a losing position for too long, which can lead to significant financial damage. The mechanics of a stop loss are relatively straightforward. When I enter a trade, I decide on a specific price point that, if reached, will trigger an automatic sell order.

This means that if the market moves against me and hits my stop loss level, my position will be closed without requiring my immediate attention. This feature is particularly beneficial in volatile markets where prices can fluctuate rapidly. By utilizing a stop loss, I can focus on my overall trading strategy rather than constantly monitoring the market for potential downturns.

Key Takeaways

- Stop loss is a predetermined point at which a trader will exit a trade to limit their losses.

- Setting stop loss in BullX is crucial for managing risk and protecting capital in a volatile market.

- Factors to consider when setting stop loss include market conditions, volatility, and individual risk tolerance.

- Strategies for setting stop loss in BullX include using technical indicators, support and resistance levels, and trailing stop orders.

- Setting stop loss based on market volatility involves adjusting the stop loss level to account for price fluctuations.

- Adjusting stop loss as the trade progresses allows traders to lock in profits and minimize potential losses.

- Monitoring and managing stop loss is essential for ensuring that it remains effective in protecting capital.

- Reviewing and refining stop loss strategies is important for adapting to changing market conditions and improving overall trading performance.

Importance of Setting Stop Loss in BullX

Setting a stop loss in BullX is crucial for several reasons. First and foremost, it helps me manage risk effectively. In the fast-paced environment of BullX, where prices can change dramatically within minutes, having a stop loss in place allows me to protect my capital from unexpected market movements.

This is especially important for traders like me who may not have the time to monitor their positions continuously throughout the day. Moreover, a well-placed stop loss can enhance my overall trading performance. By limiting losses on individual trades, I can preserve my trading capital and remain in the game longer.

This longevity is essential for any trader aiming for consistent profitability. Additionally, knowing that I have a safety net in place allows me to trade with more confidence, enabling me to make decisions based on analysis rather than fear of losing money.

Factors to Consider When Setting Stop Loss

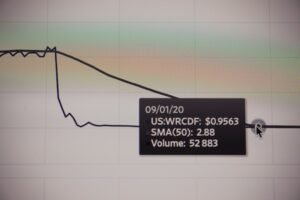

When setting a stop loss, there are several factors I must consider to ensure it is effective. One of the primary considerations is the volatility of the asset I am trading. Different assets exhibit varying levels of price fluctuations, and understanding this volatility is key to determining an appropriate stop loss level.

For instance, if I am trading a highly volatile stock, I may need to set my stop loss further away from my entry point to avoid being stopped out by normal price swings. Another important factor is my trading strategy and time frame. If I am engaging in day trading, I might opt for tighter stop losses since I am looking for quick profits and can afford to take smaller losses.

Conversely, if I am investing with a longer-term perspective, I may set wider stop losses to accommodate larger price movements over time. Additionally, I must consider my risk tolerance; knowing how much I am willing to lose on a trade will help me determine the appropriate distance for my stop loss.

Strategies for Setting Stop Loss in BullX

| Stop Loss Strategy | Description |

|---|---|

| Percentage-based Stop Loss | This strategy involves setting a stop loss at a certain percentage below the entry price to limit potential losses. |

| Support and Resistance Levels | Traders can set stop losses at key support or resistance levels to protect their positions from significant price movements. |

| Volatility-based Stop Loss | Using measures of volatility, such as Average True Range (ATR), to set stop losses based on the market's price fluctuations. |

| Trailing Stop Loss | This strategy involves adjusting the stop loss as the price moves in the trader's favor, locking in profits while still protecting against potential reversals. |

There are various strategies I can employ when setting stop losses in BullX, each tailored to different trading styles and market conditions. One common approach is the use of technical analysis to identify key support and resistance levels. By placing my stop loss just below a significant support level, I can protect myself from potential breakdowns while allowing for some price fluctuation.

This method relies on historical price data and can be particularly effective in trending markets. Another strategy involves using a percentage-based approach. In this case, I would determine a fixed percentage of my entry price that I am willing to risk on the trade.

For example, if I enter a trade at $100 and decide on a 5% stop loss, my stop loss would be set at $95.

Setting Stop Loss Based on Market Volatility

Market volatility plays a significant role in determining where to set my stop loss. In highly volatile markets, prices can swing dramatically within short periods, making it essential for me to adjust my stop loss accordingly. If I set my stop loss too close to my entry point during such times, there is a higher likelihood that normal price fluctuations will trigger it, resulting in unnecessary losses.

To account for volatility, I often look at indicators such as the Average True Range (ATR), which measures market volatility by calculating the average range between high and low prices over a specific period. By using ATR as a guide, I can set my stop loss at a distance that reflects the current market conditions. For instance, if the ATR indicates high volatility, I might set my stop loss further away from my entry point to avoid being stopped out prematurely.

Adjusting Stop Loss as the Trade Progresses

Break-Even Strategy

One common practice is to move the stop loss to break even once the trade has moved favorably in my direction by a certain amount. This adjustment allows me to eliminate the risk of losing money on the trade while still giving it room to grow.

Reevaluating Stop Loss Placement

Additionally, if the market shows signs of increased volatility or if new economic data is released that could impact the asset's price, I may choose to reevaluate my stop loss placement.

Protecting Capital and Maximizing Gains

By staying vigilant and responsive to changing conditions, I can better protect my capital and maximize potential gains.

Monitoring and Managing Stop Loss

Monitoring and managing my stop loss is an ongoing process that requires attention and discipline. While setting an initial stop loss is crucial, it is equally important for me to keep an eye on market developments that could affect my trade.

In addition to monitoring market conditions, I also pay attention to news events and economic indicators that could impact the asset I am trading. For example, if there is an upcoming earnings report or significant geopolitical event, I may choose to tighten my stop loss or even temporarily exit the trade altogether until the uncertainty subsides. This proactive approach helps me manage risk effectively while remaining adaptable in a dynamic trading environment.

Reviewing and Refining Stop Loss Strategies

Finally, reviewing and refining my stop loss strategies is an essential part of becoming a successful trader. After each trade, I take the time to analyze what worked well and what could be improved regarding my stop loss placement. This reflection allows me to learn from both successful trades and those that resulted in losses.

I also seek feedback from other traders and engage in discussions about different approaches to setting stop losses. By sharing experiences and insights with others in the trading community, I can gain new perspectives and refine my strategies further. Continuous learning and adaptation are vital components of successful trading, and by regularly reviewing my stop loss strategies, I can enhance my overall performance in BullX and beyond.

In conclusion, understanding and effectively utilizing stop losses is crucial for any trader looking to navigate the complexities of BullX successfully. By considering various factors when setting stop losses, employing different strategies based on market conditions, and continuously monitoring and refining these strategies, I can better manage risk and enhance my trading performance over time.

FAQs

What is a stop loss in BullX?

A stop loss in BullX is a predetermined price level at which a trader will exit a trade to minimize their losses. It is a risk management tool used to protect against significant losses in the event of adverse price movements.

How do you set a stop loss in BullX?

To set a stop loss in BullX, a trader can use the platform's order entry system to specify the price at which they want their position to be automatically closed if the market moves against them. This can usually be done when entering a new trade or by modifying an existing trade.

Why is setting a stop loss important in BullX?

Setting a stop loss in BullX is important because it helps traders manage their risk and protect their capital. It allows them to define their maximum loss on a trade and helps prevent emotional decision-making in the heat of the moment.

What are the different types of stop loss orders in BullX?

In BullX, traders can typically use different types of stop loss orders, such as a regular stop loss order, a trailing stop loss order, or a guaranteed stop loss order. Each type has its own specific features and benefits.

How can I determine the appropriate level for my stop loss in BullX?

The appropriate level for a stop loss in BullX can be determined based on a trader's risk tolerance, the volatility of the market, and the specific trading strategy being employed. It is important to consider these factors when setting a stop loss to ensure it is placed at a meaningful level.