Curious about the ideal number of credit cards to boost your credit score? We've got you covered. In this article, we explore the question, “How many credit cards should I have to build credit?” while shedding light on whether one or two credit cards can do the trick. Discover the key factors to consider when deciding on your credit card strategy, from maintaining a healthy credit utilization ratio to managing your payments effectively. So, if you've ever wondered about the magic number of credit cards for building credit, keep reading to find out more.

This image is property of images.moneycontrol.com.

Best Credit Cards To Build Credit

Factors to Consider

Credit Utilization

When considering how many credit cards you should have to build credit, one important factor to consider is credit utilization. Credit utilization refers to the percentage of your available credit that you are currently using. A low credit utilization ratio is generally viewed positively by lenders and can have a positive impact on your credit score. By having multiple credit cards, you can distribute your spending across different accounts and keep your individual credit utilization on each card low.

Credit History Length

Another factor to consider is the length of your credit history. Credit history length plays a significant role in building credit and demonstrating your ability to manage credit responsibly over time. If you have just one credit card, your credit history may not be as long as someone who has multiple cards. By having multiple credit cards and maintaining a good payment history, you can help lengthen and strengthen your credit history.

Payment History

Your payment history is a crucial factor in determining your creditworthiness. Making timely payments and consistently paying at least the minimum amount due can have a positive impact on your credit score. Having multiple credit cards provides an opportunity to demonstrate a positive payment history across different accounts, which can reflect positively on your credit report.

Types of Credit

The types of credit you have also play a role in building credit. There are different types of credit, including revolving credit and installment credit. Revolving credit, such as credit cards, allows you to borrow up to a certain credit limit and pay off the balance over time. Installment credit, on the other hand, involves borrowing a specific amount of money and repaying it in fixed monthly installments. By having a mix of different types of credit, you can show lenders that you can manage different types of loans responsibly.

Inquiries on Credit Report

Inquiries on your credit report can also affect your credit score. There are two types of inquiries: hard inquiries and soft inquiries. Hard inquiries occur when a lender or creditor reviews your credit report as part of a credit application. These inquiries can have a temporary negative impact on your credit score. On the other hand, soft inquiries occur when you pull your own credit report for informational purposes or when lenders perform a background check. Soft inquiries do not impact your credit score. By having multiple credit cards, you may be more likely to have multiple hard inquiries, which can have a short-term impact on your credit score.

Understanding Credit Utilization

Explanation

Credit utilization refers to the percentage of your available credit that you are currently using. It is calculated by dividing your credit card balances by your credit limits and multiplying by 100. For example, if you have a credit limit of $5,000 and a balance of $1,000, your credit utilization ratio is 20%. A lower credit utilization ratio is generally better for your credit score as it indicates responsible credit management.

Impact on Credit Score

Credit utilization has a significant impact on your credit score. A high credit utilization ratio can indicate that you are relying too heavily on credit and may pose a higher risk to lenders. This can result in a lower credit score. On the other hand, a low credit utilization ratio reflects responsible credit usage and can positively impact your credit score.

By having multiple credit cards, you can distribute your spending across different accounts and keep your individual credit utilization on each card low. This can help improve your overall credit utilization ratio and positively impact your credit score. However, it's important to note that simply having multiple credit cards does not guarantee a low credit utilization ratio. It is essential to manage your credit responsibly and avoid maxing out your credit limits on each card.

Top Credit Cards For Building Credit

Credit History Length

Role in Building Credit

Your credit history length plays a crucial role in building credit. It demonstrates your ability to manage credit responsibly over time. The longer your credit history, the more information lenders have to assess your creditworthiness. If you have just one credit card, your credit history may not be as long as someone with multiple cards. By having multiple credit cards and maintaining a good payment history, you can help lengthen and strengthen your credit history.

Determining Factors

The length of your credit history is determined by several factors, including the age of your oldest account, the average age of all your accounts, and the overall length of your credit history. By having multiple credit cards, you can potentially have accounts with different ages, which can contribute to a more robust credit history. However, it's important to note that opening new credit cards can also temporarily lower the average age of your accounts, which can have a slight negative impact on your credit score. Therefore, it's essential to consider the impact on your credit history length when deciding how many credit cards to have.

Significance of Payment History

Positive Payment History

Your payment history is one of the most critical factors in determining your creditworthiness. Making timely payments and consistently paying at least the minimum amount due can have a positive impact on your credit score. By having multiple credit cards, you have more opportunities to demonstrate a positive payment history. Each on-time payment across different accounts reflects responsible credit management and can help improve your credit score.

Negative Payment History

Conversely, a negative payment history can have a significant negative impact on your credit score. Late payments, defaults, and accounts in collections can all severely harm your creditworthiness. By having multiple credit cards, you have more accounts to manage and a greater responsibility to ensure timely payments. It's essential to stay organized and make payments on time for each card to avoid any negative impact on your credit score.

This image is property of www.chime.com.

Credit Cards For Building A Strong Credit Score

Types of Credit

Revolving Credit

Revolving credit refers to credit that allows you to borrow up to a specific credit limit and repay it over time. Credit cards are a common example of revolving credit. With a credit card, you can make purchases up to your credit limit, and as you make payments, your available credit is replenished. Revolving credit provides flexibility in how much you borrow and repay each month.

Installment Credit

Installment credit involves borrowing a specific amount of money and repaying it in fixed monthly installments over a predetermined period. Examples of installment credit include auto loans, mortgages, and personal loans. With installment credit, you have a set repayment schedule and a fixed loan amount.

Open Credit

Open credit refers to credit that must be paid in full at the end of each billing cycle. Charge cards are a common example of open credit. With a charge card, there is no preset spending limit, but you must pay off the full balance each month. Open credit provides flexibility in spending without accruing revolving debt.

Impact on Credit Score

Having a mix of different types of credit can positively impact your credit score. It demonstrates your ability to manage various types of loans and credit arrangements responsibly. By having multiple credit cards, you can diversify your credit types and potentially improve your credit score.

Effect of Inquiries on Credit Report

Hard Inquiries

Hard inquiries occur when a lender or creditor reviews your credit report as part of a credit application. Examples include applying for a new credit card, a loan, or a mortgage. When a hard inquiry is made, it is visible on your credit report for up to two years. Multiple hard inquiries can have a temporary negative impact on your credit score, as they can suggest increased credit risk or financial instability.

Soft Inquiries

Soft inquiries occur when you pull your own credit report for informational purposes or when lenders perform a background check. Soft inquiries do not impact your credit score and are not visible to lenders. Monitoring your own credit report or receiving pre-approved credit offers does not harm your credit score.

By having multiple credit cards, you may be more likely to have multiple hard inquiries. However, the impact of hard inquiries on your credit score is generally minimal and temporary. It's important to be mindful of the number of credit applications you make, but having multiple credit cards should not deter you from building credit.

This image is property of d94tn94v8mvlz.cloudfront.net.

How Many Credit Cards Should I Have to Build Credit?

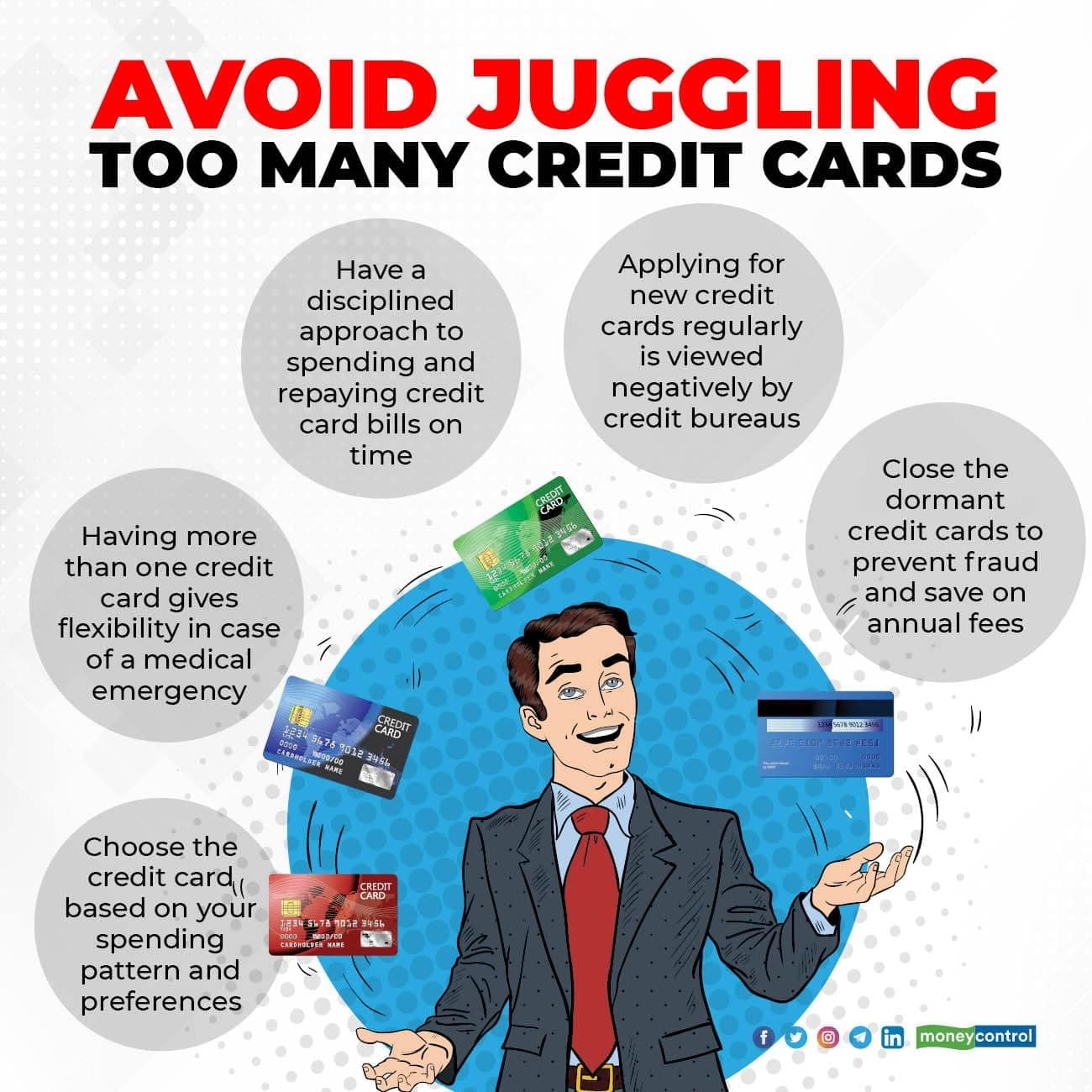

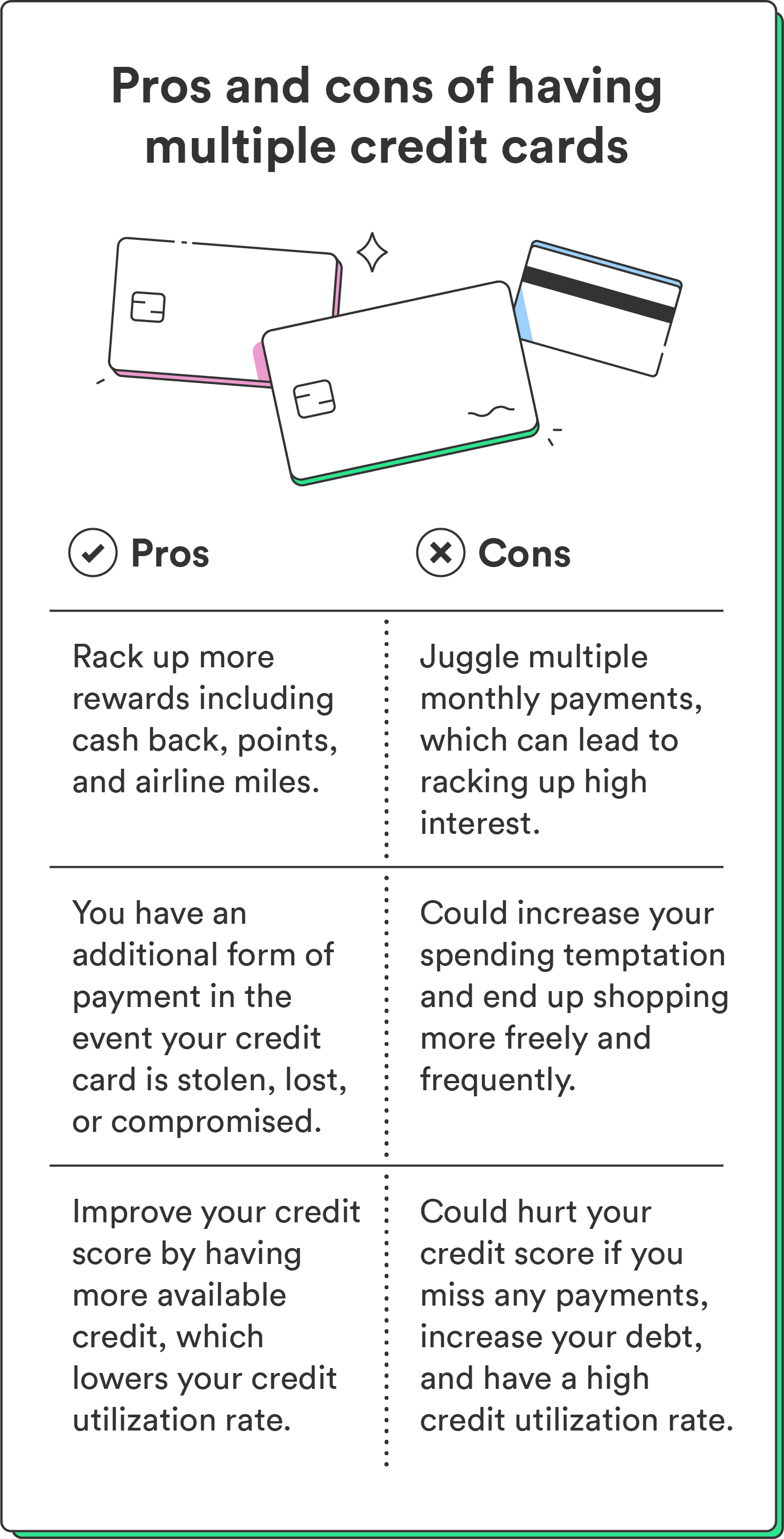

Pros and Cons of Multiple Credit Cards

Advantages

Having multiple credit cards offers several advantages. First, it provides increased available credit. The total credit limit across all your cards determines your available credit, and having multiple cards can give you a higher credit limit, which can be beneficial for managing expenses and emergencies. Additionally, having multiple credit cards allows you to diversify your credit utilization, which can positively impact your credit score.

Another advantage of having multiple credit cards is that it allows you to take advantage of different rewards programs and promotional offers. Different credit cards offer different rewards, such as cash back, travel points, or discounts on specific purchases. By having multiple cards, you can choose the card that offers the best rewards for each specific purchase.

Disadvantages

While there are advantages to having multiple credit cards, there are also potential disadvantages. One disadvantage is the temptation to overspend. With multiple cards, it can be easy to lose track of your overall spending and end up with more debt than you can comfortably manage. It's important to have a clear budget and exercise self-discipline to avoid excessive spending.

Another potential disadvantage is the potential for increased fees. Each credit card may come with its own annual fees, balance transfer fees, or other charges. It's important to consider the costs associated with each card and whether the benefits outweigh the fees.

Building Credit with a Single Credit Card

Managing Credit Utilization

If you choose to build credit with a single credit card, managing credit utilization becomes even more important. With just one credit card, you have a limited credit limit, and it's crucial to keep your credit utilization low to ensure a good credit score. Aim to keep your credit card balance below 30% of your credit limit. This demonstrates responsible credit usage and can positively impact your credit score.

Maintaining Good Payment History

When building credit with a single credit card, maintaining a good payment history is essential. Make all payments on time and in full to demonstrate responsible credit management. Consistently paying at least the minimum amount due can also help you avoid late fees and penalties.

Lengthening Credit History

With a single credit card, it may take longer to lengthen your credit history. To mitigate this, consider keeping your oldest credit card account open, even if you acquire new credit cards. This way, you can maintain the age of your credit history while still benefiting from the advantages of having multiple credit cards.

Tracking Credit Report Inquiries

If you have a single credit card, it's essential to track inquiries on your credit report. Hard inquiries can temporarily lower your credit score, so it's important to minimize unnecessary credit applications. By monitoring your credit report regularly and being selective about the credit you pursue, you can minimize the impact of inquiries on your credit score.

This image is property of thumbor.forbes.com.

Benefits of Having Multiple Credit Cards

Increased Available Credit

One significant benefit of having multiple credit cards is increased available credit. The total credit limit across all your cards determines your available credit. This can be advantageous when managing larger expenses or unexpected emergencies. By having multiple cards, you have additional credit available to you, providing financial flexibility and peace of mind.

Improved Credit Utilization

Having multiple credit cards allows you to diversify your credit utilization. Instead of relying heavily on one card and potentially maxing out its credit limit, you can distribute your spending across different cards. This helps keep individual credit utilization ratios low and can positively impact your credit score. By effectively managing your credit utilization, you demonstrate responsible credit usage and maintain a healthy credit profile.

Diversification of Credit Types

Another benefit of having multiple credit cards is the opportunity to diversify your credit types. Different credit cards may offer different benefits, rewards, and promotional offers. By having a mix of credit cards, you can leverage the advantages of each card and tailor your usage based on your specific needs. This diversification showcases your ability to manage different types of credit, which can positively impact your creditworthiness.

Enhanced Credit History

Having multiple credit cards can also enhance your credit history. Each card represents an individual account, and by maintaining a good payment history and utilizing your credit responsibly across multiple accounts, you can demonstrate a solid credit history. This can improve your creditworthiness and open doors to better interest rates and financial opportunities.

Expert Recommendations

Range of Credit Cards

Financial experts recommend having a range of credit cards to optimize your credit-building efforts. This typically means having at least two to three credit cards. By having multiple cards, you can diversify your credit type, increase your available credit, and improve your credit utilization. However, it's important to note that the number of credit cards you should have ultimately depends on your individual financial situation and ability to manage credit responsibly.

Building Credit without Credit Cards

While credit cards can be effective in building credit, they are not the only means to do so. If you prefer to avoid credit cards or cannot qualify for them, there are alternative ways to build credit. For instance, you can consider taking out a small personal loan or using a secured credit card, where you provide a cash deposit as collateral. These options can help establish credit history and demonstrate your ability to manage credit responsibly.

Building credit is a journey that requires responsible credit management and a thorough understanding of the factors that impact your credit score. By considering factors such as credit utilization, credit history length, payment history, types of credit, and inquiries on your credit report, you can make informed decisions on how many credit cards to have. Whether you choose to build credit with a single credit card or multiple cards, the key is to manage your credit responsibly, make timely payments, and maintain a healthy credit profile. With proper credit management, you can build a strong credit foundation and open doors to a brighter financial future.