Are you looking to build your credit but don't know where to start? Look no further than Kickoff! With Kickoff's credit builder program, you can establish and improve your creditworthiness in no time. It's a hassle-free and straightforward process that doesn't require any credit history or minimum credit score. Whether you're a student, a young professional, or someone looking to rebuild their credit, Kickoff is here to help you take the first step towards financial success. Get ready to unlock new opportunities and achieve your financial goals with Kickoff!

This image is property of thecollegeinvestor.com.

Understanding Credit Building

Credit building is an important aspect of personal finance that you should prioritize in order to achieve your financial goals. Building credit involves establishing a solid credit history and maintaining a good credit score. A good credit score is crucial as it determines your creditworthiness when applying for loans, renting an apartment, or even applying for a job.

Why Building Credit is Important

Building credit is important as it demonstrates your ability to responsibly handle debt and financial obligations. A good credit history allows lenders to evaluate your creditworthiness and determine whether you are a reliable borrower. A strong credit history can also lead to lower interest rates on future loans, saving you money in the long run.

What is a Credit Score

A credit score is a three-digit number that represents your creditworthiness. It is based on your credit history and provides lenders with an understanding of how likely you are to repay your debts. The most commonly used credit score is the FICO score, which ranges from 300 to 850. The higher your credit score, the better your chances of getting approved for credit or loans.

How Credit Scores are Calculated

Credit scores are calculated using various factors, including your payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. Your payment history is the most significant factor, accounting for approximately 35% of your credit score. By understanding how credit scores are calculated, you can take steps to improve your creditworthiness.

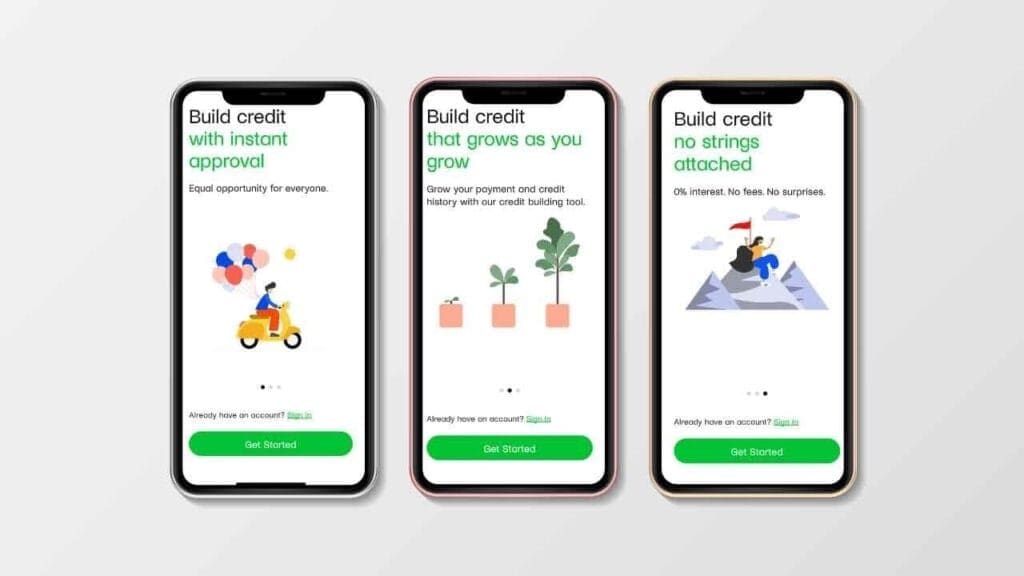

Getting Started with Kikoff

If you are looking for a reliable tool to help you build credit, Kikoff is the solution for you. Kikoff is a financial platform that specializes in credit building. It offers a Credit Builder Account that allows you to establish a positive credit history without the need for traditional loans.

What is Kikoff

Kikoff is an innovative financial platform that aims to help individuals build credit effectively. It offers a variety of tools and resources to assist you in achieving your credit building goals. With Kikoff, you can take control of your financial future and lay the foundation for a strong credit history.

How Kikoff Helps Build Credit

Kikoff helps build credit by providing you with a Credit Builder Account. This account enables you to make monthly payments that are reported to the credit bureaus, helping you establish a positive payment history. By consistently making on-time payments, you can improve your credit score over time.

Who Can Benefit from Kikoff

Kikoff is designed for anyone who needs to build or improve their credit. Whether you are just starting your credit journey or trying to recover from past mistakes, Kikoff can be an invaluable tool. It is especially beneficial for individuals with limited credit history or those who are unable to qualify for traditional loans.

This image is property of eddyballe.com.

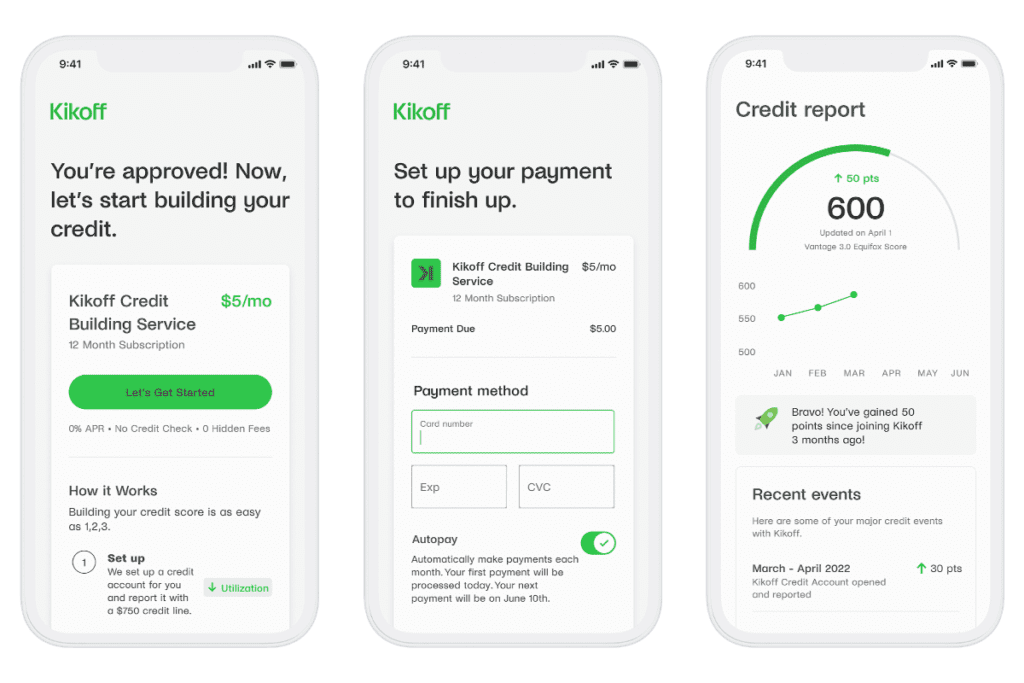

Signing Up for Kikoff

Getting started with Kikoff is a simple and straightforward process. Follow these steps to create your account and start building your credit:

Creating an Account

To create an account with Kikoff, visit their website and click on the sign-up button. You will need to provide some basic information such as your name, email address, and password. Once you have filled in the required details, you can proceed to the next step.

Providing Personal Information

After creating your account, you will be prompted to provide personal information necessary for identity verification. This may include your Social Security number, date of birth, and address. Rest assured that Kikoff takes the security of your personal information seriously and uses encryption to protect your data.

Verifying Identity

To ensure the accuracy and validity of the information provided, Kikoff may require you to verify your identity. This process typically involves uploading a photo of a government-issued ID such as a driver's license or passport. Once your identity has been verified, you can proceed to set up your Credit Builder Account.

Using Kikoff to Build Credit

Now that you have successfully signed up for Kikoff and established your account, it's time to start utilizing the platform to build your credit. Here's what you need to do:

Setting Up the Credit Builder Account

To set up your Credit Builder Account, you will need to link your existing bank account. This allows Kikoff to track your payments and ensure they are reported to the credit bureaus. Once you have linked your bank account, you can start making payments towards your Credit Builder Account.

Making On-Time Monthly Payments

Making on-time monthly payments is the key to building credit with Kikoff. By consistently paying your Credit Builder Account on time, you demonstrate your ability to handle financial obligations responsibly. These payments will be reported to the credit bureaus, gradually improving your credit score.

Understanding the Impact on Credit Score

It's important to understand that credit building takes time. While Kikoff's Credit Builder Account can help you establish a positive credit history, it may take several months or even years to see significant improvements in your credit score. Remember to be patient and stay consistent with your payments to maximize the positive impact on your credit score.

This image is property of bestreferraldriver.com.

Building a Positive Credit History

Building a positive credit history is crucial for long-term credit success. Here are some tips to help you establish and maintain a strong credit history:

Why Consistency is Key

Consistency is key when it comes to building credit. Make it a habit to pay all of your bills on time, not just your Credit Builder Account payment. Consistently meeting your financial obligations demonstrates your reliability as a borrower and strengthens your creditworthiness.

Avoiding Late Payments

Late payments can have a significant negative impact on your credit history. It's essential to prioritize paying your bills on time to avoid late payment penalties and potential damage to your credit score. Consider setting up automated payments or reminders to ensure you never miss a due date.

Staying Within Credit Limits

Another crucial aspect of building a positive credit history is managing your credit utilization. Credit utilization refers to the percentage of your available credit that you are currently utilizing. It is recommended to keep your credit utilization below 30% to demonstrate responsible credit usage. Stay within your credit limits to avoid potential negative effects on your credit score.

Monitoring Progress with Kikoff

Kikoff provides valuable tools to help you monitor your progress and stay informed about your credit journey. Here's how you can leverage these resources:

Tracking Credit Score Improvement

Kikoff allows you to track your credit score improvement over time. By regularly checking your credit score, you can see firsthand the positive impact of your efforts. Monitoring your score also allows you to identify any potential issues or errors in your credit report that may need to be addressed.

Understanding Credit Report Changes

In addition to tracking your credit score, it is essential to have a clear understanding of the changes reflected in your credit report. Kikoff provides insights into your credit report, highlighting any new accounts, payment history updates, or other changes that could affect your creditworthiness. This information allows you to stay informed and take necessary actions to protect and improve your credit.

Receiving Credit Alerts

Kikoff offers credit alerts to keep you updated on any significant changes or events related to your credit. These alerts serve as an early warning system, notifying you of potential issues such as late payments or identity theft. By receiving these alerts, you can promptly address any concerns and take appropriate actions to safeguard your credit.

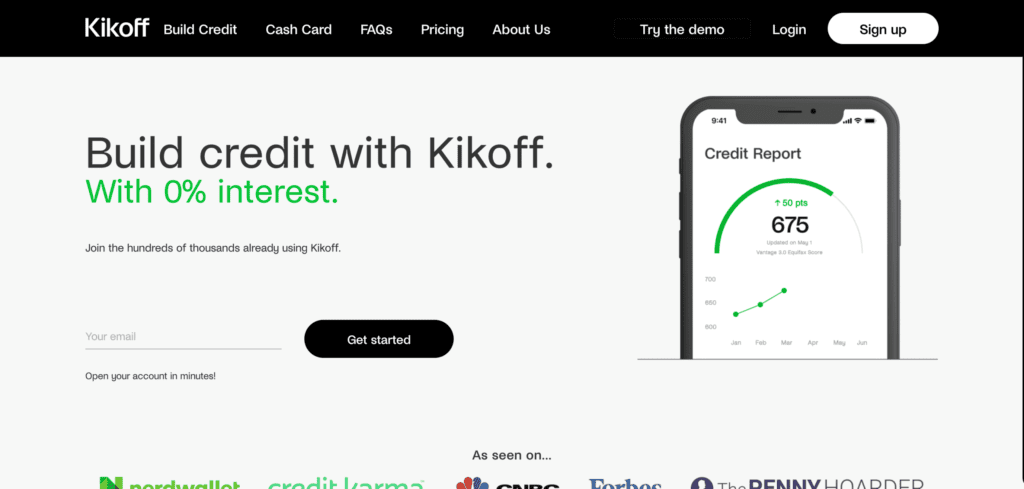

This image is property of kikoff-public-assets.s3.us-west-2.amazonaws.com.

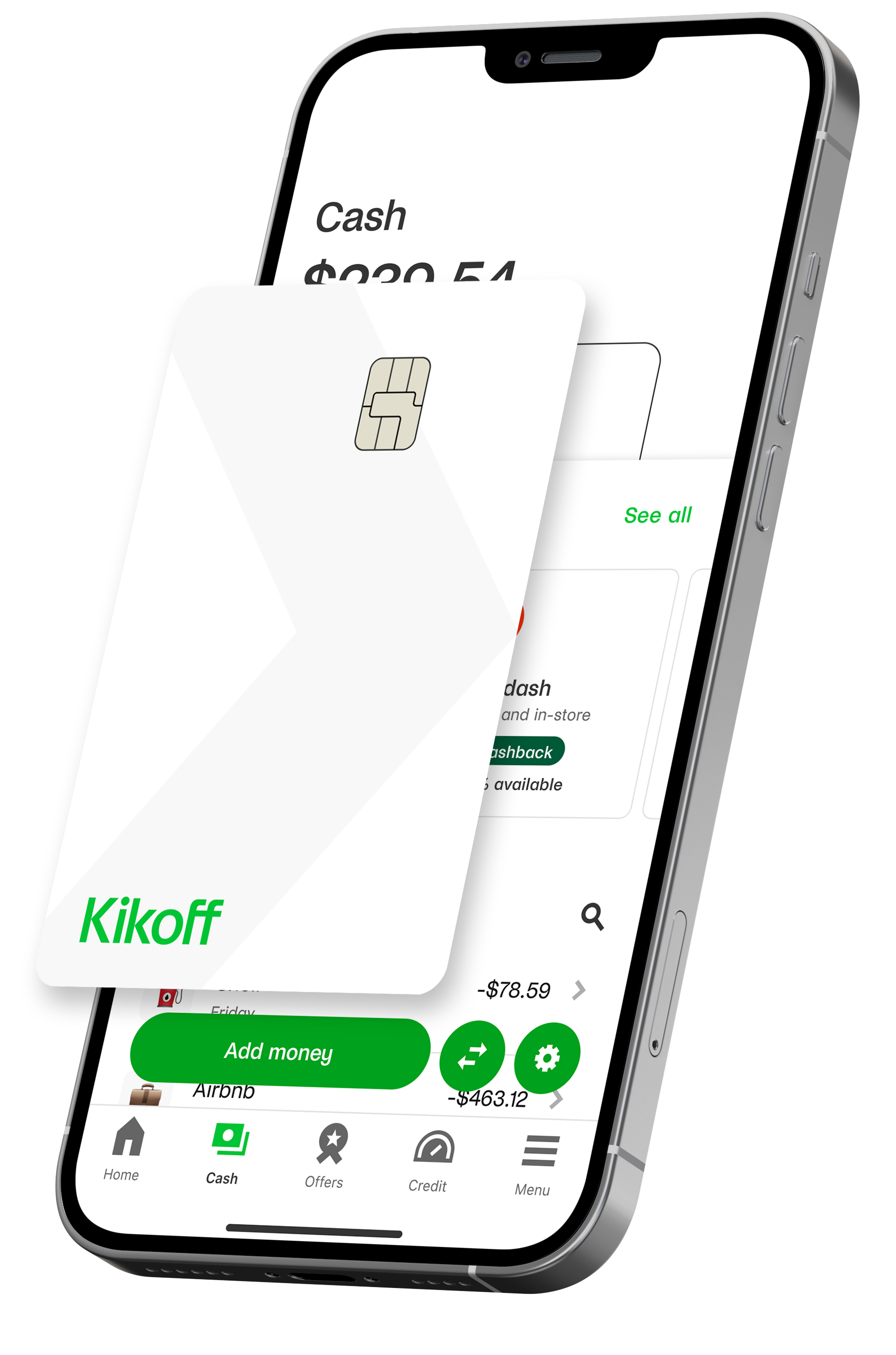

Benefits of Kikoff's Credit Builder

Kikoff's Credit Builder Account offers several benefits that make it a valuable tool for credit building:

Access to Credit without Traditional Loans

Kikoff provides an alternative method of building credit without relying on traditional loans. This is particularly beneficial for individuals who may not have access to credit due to lack of credit history or poor credit. With Kikoff, you can establish credit without the need for a credit card or other traditional loan products.

Establishing Credit History for Beginners

For individuals who are just starting their credit journey, Kikoff offers a convenient and accessible way to establish a positive credit history. By making on-time payments through the Credit Builder Account, you can start building credit from scratch and lay the foundation for a healthy financial future.

Lowering Interest Rates on Future Loans

By consistently building credit with Kikoff, you increase your chances of qualifying for loans with lower interest rates in the future. A strong credit history and an improved credit score make you a more attractive borrower for lenders, leading to better loan terms and potentially substantial savings.

Tips for Successful Credit Building

Building credit is a long-term process that requires commitment and smart financial habits. Consider the following tips to ensure your credit building journey is successful:

Paying Bills on Time

This cannot be emphasized enough – paying all of your bills on time is crucial for building and maintaining good credit. Late payments can have a lasting negative impact on your credit history, so make it a priority to meet your financial obligations promptly.

Keeping Credit Utilization Low

Maintaining a low credit utilization ratio is an essential aspect of credit building. Aim to keep your credit utilization below 30% to demonstrate responsible credit usage. By consistently paying down your balances and avoiding carrying high levels of debt, you can improve your creditworthiness.

Limiting Credit Applications

Applying for multiple lines of credit within a short period can raise red flags for lenders. Limiting the number of credit applications you make can help protect your credit score and prevent unnecessary inquiries on your credit report. Be selective with your credit applications and only apply for credit when necessary.

This image is property of kikoff.com.

Common Credit Building Mistakes to Avoid

To ensure your credit building efforts are successful, it's important to steer clear of common mistakes that can hinder your progress. Here are a few mistakes to avoid:

Missing Payments

Late or missed payments can significantly damage your credit history. It's essential to make all of your payments on time to maintain a positive credit profile. Consider setting up reminders or automated payments to avoid accidental oversights.

Maxing Out Credit Cards

Using up your entire credit limit can raise concerns for lenders and negatively impact your credit score. Aim to keep your credit utilization ratio below 30% to demonstrate responsible credit usage. If possible, pay off your balances in full each month to avoid accruing high-interest charges.

Closing Old Credit Accounts

Closing old credit accounts may seem like a good idea, but it can actually harm your credit history. The length of your credit history is a factor in calculating your credit score, so closing old accounts shortens your history. Instead, keep your old accounts open, even if you no longer use them, to maintain a positive credit profile.

Frequently Asked Questions about Kikoff

How Long Does it Take to Build Credit with Kikoff?

Building credit is a gradual process that requires consistent effort over time. While the exact timeline varies for each individual, many people start seeing improvements in their credit score within six months to a year of using Kikoff's Credit Builder Account. However, it is important to remember that building credit is a long-term commitment, and it may take several years to achieve an excellent credit score.

What Happens if I Miss a Payment?

If you miss a payment on your Kikoff Credit Builder Account, it can have a negative impact on your credit history. Late or missed payments are reported to the credit bureaus, which can lead to a decrease in your credit score. To avoid this, it is essential to make all of your payments on time and budget accordingly to meet your financial obligations.

Can Kikoff Help Improve an Existing Credit Score?

Yes, Kikoff can help improve an existing credit score. By using the Credit Builder Account to make on-time monthly payments, you can demonstrate responsible financial behavior and establish a positive payment history. Consistently making payments and avoiding late payments can lead to an improved credit score over time. Remember that credit improvement is a gradual process, and it may take time to see significant changes in your score.

In conclusion, building credit is an essential aspect of personal finance that can significantly impact your financial future. Kikoff offers a user-friendly platform to help you build credit effectively, even if you have limited credit history or previous credit challenges. By utilizing the resources and tools provided by Kikoff, you can establish a positive credit history, improve your credit score, and lay the foundation for a strong financial future. Remember to practice good financial habits, such as making on-time payments and managing credit responsibly, to ensure long-term credit success.