In this article, you will learn about Fundrise and how it provides an easy way to invest in real estate. Fundrise offers various investment plans that allow you to get started in the real estate market, even if you don't have a huge amount of capital. You will discover how these investment plans work and the potential benefits they offer.

Fundrise offers a range of investment plans to suit your needs and goals. Whether you are looking for short-term or long-term investments, Fundrise has options to cater to different timeframes. With these plans, you can diversify your portfolio by investing in a variety of real estate projects, such as residential or commercial properties. The process is straightforward, allowing you to easily navigate through the investment options and choose the plan that aligns with your investment objectives. With Fundrise, investing in real estate has never been easier.

Fundrise: Investing in Real Estate Made Easy

Investing in real estate has long been considered a great way to build wealth and generate passive income. However, the traditional methods of investing in real estate, such as acquiring properties directly or investing in real estate investment trusts (REITs), have often been inaccessible to the average investor.

This is where Fundrise comes in. Fundrise is an innovative online platform that provides an opportunity for individuals to invest in real estate with ease and convenience. By pooling investors' funds, Fundrise is able to offer access to high-quality real estate projects that were previously only available to institutional investors.

Fundrise in a Nutshell

Fundrise is essentially a real estate crowdfunding platform that allows individuals to invest in a diversified portfolio of real estate assets. The platform was founded in 2012 with the goal of democratizing real estate investing and making it accessible to everyone.

Unlike traditional real estate investment methods, Fundrise allows investors to start with as little as $500, making it an attractive option for those who may not have a large amount of capital to begin with. The platform offers a range of investment plans, each tailored to different investment goals and risk tolerances.

How Does Fundrise Work?

Fundrise works by pooling investors' funds and using them to invest in a portfolio of real estate assets. The platform carefully selects and manages these investments, ensuring that they meet the platform's strict investment criteria. Investors can then choose to invest in one or more of Fundrise's investment plans, depending on their individual preferences.

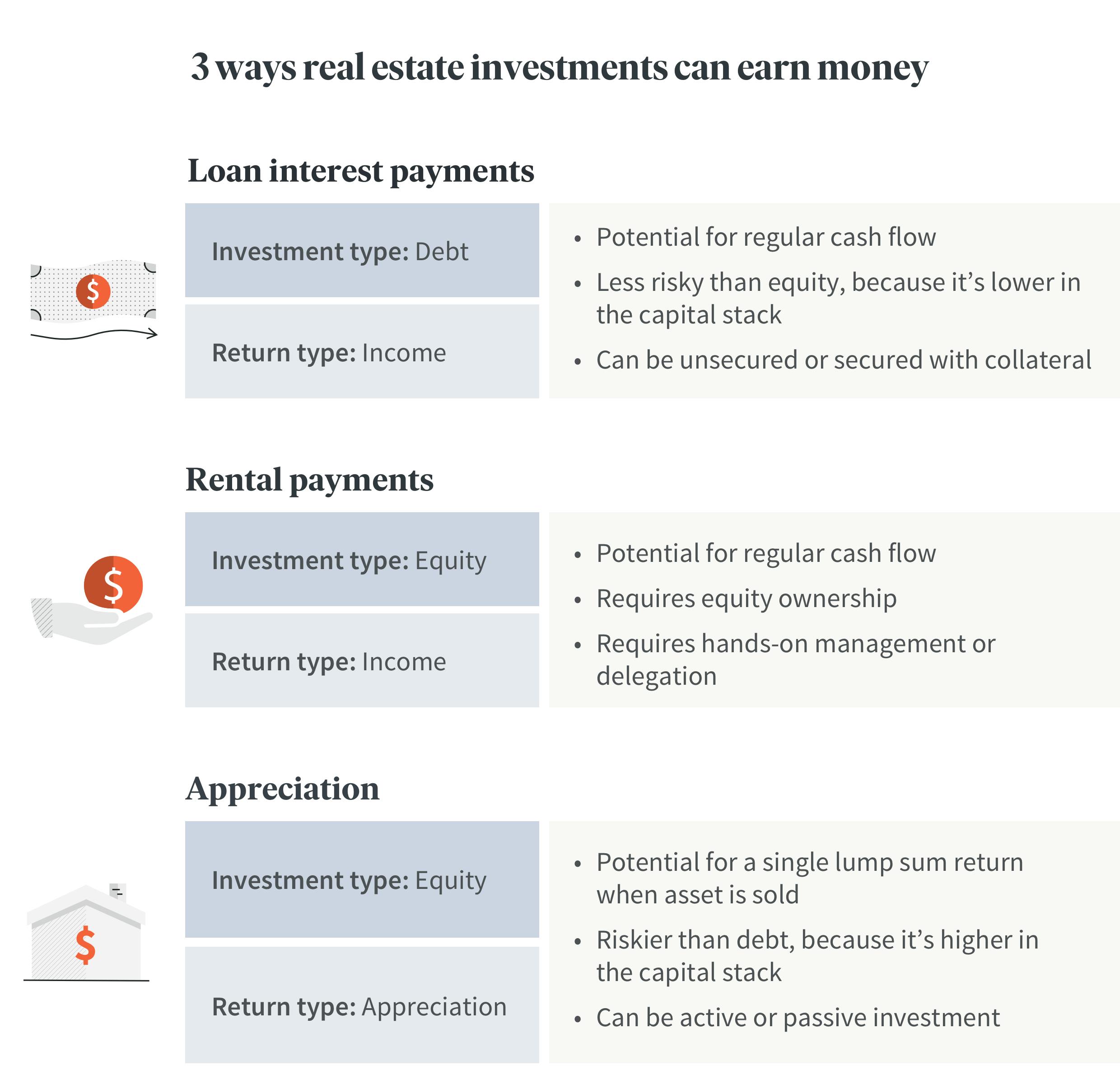

Fundrise offers a range of investment options, including equity investments, debt investments, preferred equity investments, eREITs, and eFunds. Each investment type offers different risk and return characteristics, allowing investors to diversify their portfolio according to their preferences.

Benefits of Investing with Fundrise

There are several benefits to investing with Fundrise:

-

Accessibility: Fundrise allows both accredited and non-accredited investors to participate, making it accessible to a wide range of individuals. This is in contrast to many traditional real estate investment methods that require a high net worth or specific accreditation.

-

Diversification: Fundrise offers investors the opportunity to diversify their portfolio across different types of real estate investments, such as residential, commercial, and industrial properties. This diversification helps to mitigate risk and allows investors to benefit from the potential growth of multiple markets.

-

Professional Management: Fundrise's team of experienced professionals carefully selects and manages the real estate investments on the platform. This expertise helps to ensure that investors' funds are invested in high-quality projects that offer the potential for attractive returns.

-

Lower Costs: By operating online and utilizing a crowdfunding model, Fundrise is able to bypass many of the costs associated with traditional real estate investment methods. This allows the platform to offer lower fees and expenses, ultimately benefiting investors.

Types of Investments Offered by Fundrise

Fundrise offers a range of investment options to suit different investor preferences and risk tolerances. These include:

Equity Investments

Equity investments involve purchasing a stake in a real estate project and receiving a share of the income and appreciation generated by the property. This type of investment offers the potential for higher returns but also carries a higher level of risk.

Debt Investments

Debt investments involve lending money to a real estate project in exchange for regular interest payments. These investments are generally considered lower risk compared to equity investments, as debt investors have priority in the event of default.

Preferred Equity Investments

Preferred equity investments combine features of both equity and debt investments. Investors receive a fixed return, similar to debt investments, but also benefit from any appreciation in the property's value, like equity investments.

eREITs

eREITs, or electronic real estate investment trusts, are a type of investment vehicle that allows investors to pool their funds and invest in a diversified portfolio of real estate assets. eREITs offer the benefits of traditional REITs, such as liquidity and diversification, but with lower fees and higher potential returns.

eFunds

eFunds are similar to eREITs but focus on specific real estate projects or sectors. These funds allow investors to target their investments towards particular opportunities or markets, providing greater control and customization.

How to Get Started with Fundrise

Getting started with Fundrise is a straightforward process. Here are the steps to follow:

Creating an Account

The first step is to create an account on the Fundrise platform. This involves providing some personal information, such as your name, email address, and contact details. Fundrise takes security seriously and employs various measures to protect your personal information.

Choosing an Investment Plan

Once your account is set up, you can start exploring the different investment plans offered by Fundrise. Each plan has a different investment strategy and risk profile, so it's important to understand your own investment goals and risk tolerance before making a decision.

Setting Investment Goals

Before investing, it's crucial to determine your investment goals. Are you looking for long-term capital appreciation, regular income, or a combination of both? Having a clear understanding of your goals will help you make informed investment decisions and choose the most appropriate investment plan.

Determining Investment Amount

Once you've chosen an investment plan and set your goals, you'll need to determine how much you want to invest. Fundrise offers a minimum investment requirement of $500, but you can choose to invest more if you wish. It's important to consider your financial situation and invest only what you can afford to lose.

Diversification Strategies

Diversification is a key principle of investing, and Fundrise offers several strategies to help investors achieve a diversified portfolio.

Importance of Diversification

Diversification involves spreading investments across different assets or asset classes, reducing the risk of exposure to any single investment. By diversifying, investors can potentially mitigate the impact of market volatility and protect their portfolio from significant losses.

Fundrise Portfolio Diversification

Fundrise aims to achieve diversification by investing in a wide range of real estate assets across different markets and sectors. This diversification helps to reduce risk and provides investors with exposure to various income streams and potential sources of appreciation.

Geographical Diversification

Fundrise also focuses on geographical diversification, investing in properties located in different cities and regions across the United States. This approach helps to reduce the risk associated with investing in a single market and allows investors to benefit from the potential growth of multiple locations.

Asset Class Diversification

In addition to geographical diversification, Fundrise offers a variety of investment options across different asset classes. Investors can choose from equity investments, debt investments, preferred equity investments, eREITs, and eFunds, allowing them to diversify their portfolio according to their preferences and risk tolerance.

Marketplace vs. eREITs

When considering real estate investment options, it's important to understand the differences between traditional real estate marketplaces and eREITs offered by platforms like Fundrise.

Traditional Real Estate Marketplace

Investing in real estate through the traditional marketplace typically involves purchasing properties directly or participating in syndications. This approach requires a significant amount of capital and often comes with high transaction costs and ongoing management responsibilities.

Benefits of Investing in eREITs

Investing in eREITs, on the other hand, allows investors to pool their funds with others and invest in a diverse portfolio of real estate assets. This approach offers several benefits, including:

-

Diversification: eREITs allow investors to gain exposure to a wide range of properties and markets, reducing the risk associated with investing in a single property or market.

-

Liquidity: Unlike traditional property investments, eREITs offer greater liquidity. Investors can buy and sell shares of eREITs on the secondary market, providing flexibility and the ability to access their funds when needed.

-

Professional Management: eREITs are managed by experienced professionals who carefully select and manage the portfolio of assets. This allows investors to benefit from the expertise of the Fundrise team without the need for active management.

eREIT vs. Traditional REIT

eREITs and traditional REITs have some similarities, but there are important differences to consider. While both provide exposure to real estate assets, eREITs often have lower fees and expenses compared to traditional REITs. Additionally, eREITs are often more accessible to individual investors, whereas traditional REITs are primarily targeted towards institutional investors.

Potential Risks and Mitigation

As with any investment, there are risks associated with investing in real estate. However, Fundrise has implemented risk mitigation strategies to help protect investors' capital and manage potential risks.

Market Risk

Market risk refers to the potential for investments to decline in value due to macroeconomic factors or changes in investor sentiment. Real estate investments are subject to market risk, as property values can fluctuate based on factors such as supply and demand, interest rates, and economic conditions.

Fundrise seeks to mitigate market risk by carefully selecting properties and markets that have the potential for long-term growth and are less susceptible to short-term fluctuations. The platform also diversifies its portfolio across different markets and sectors, reducing the impact of any single investment.

Liquidity Risk

Liquidity risk refers to the potential difficulty of selling an investment and converting it into cash quickly. Real estate investments are generally considered illiquid, as it can take time to find a buyer and complete a sale.

Fundrise addresses liquidity risk by providing investors with liquidity options. While eREITs have limited liquidity compared to traditional stocks, Fundrise has implemented a redemption program that allows investors to sell their shares in eREITs quarterly, providing some flexibility to access their funds when needed.

Interest Rate Risk

Interest rate risk refers to the potential impact of changes in interest rates on real estate values. When interest rates rise, the cost of borrowing increases, which can lead to lower property valuations. Conversely, when interest rates fall, it can stimulate demand for real estate and lead to higher property valuations.

Fundrise manages interest rate risk by carefully monitoring market conditions and adjusting its investment strategies accordingly. The platform seeks to identify investment opportunities that are less sensitive to changes in interest rates and have the potential for consistent performance regardless of the interest rate environment.

Fundrise Risk Mitigation Strategies

In addition to the strategies mentioned above, Fundrise implements other risk mitigation measures to help protect investors' capital. These include thorough due diligence on potential investments, active asset management, and a disciplined approach to underwriting and portfolio construction.

While these risk mitigation strategies can help reduce the potential impact of risks, it's important to note that investing in real estate, including through Fundrise, still carries inherent risks. Investors should carefully consider their own risk tolerance and investment objectives before making any investment decisions.

Fundrise Fees and Costs

Before investing, it's important to understand the fees and costs associated with investing with Fundrise. While the platform aims to keep costs low compared to traditional real estate investment options, it's important to be aware of these expenses.

Management Fees

Fundrise charges an annual management fee based on the total value of an investor's portfolio. The fee ranges from 0.15% to 0.30% annually, depending on the specific investment plan chosen. This fee covers the cost of managing the investments, conducting due diligence, and providing ongoing investor support.

Advisory Fees

In addition to management fees, Fundrise charges an annual advisory fee for providing investment advisory services. The fee ranges from 0.15% to 0.30% annually and is deducted from the investor's annual dividend distribution.

Operating Costs

Operating costs, such as legal, accounting, and administrative expenses, are also incurred by Fundrise. These costs are reimbursed to the platform by the investment entities and are deducted from the income generated by the investments.

It's important to note that these fees and costs can potentially reduce the overall returns of an investment. However, Fundrise aims to keep these costs competitive and transparent, allowing investors to make informed decisions based on their individual investment objectives.

Performance and Returns

When considering investing with Fundrise, it's important to understand the historical performance and potential returns of the platform. While past performance is not indicative of future results, it can provide insights into the platform's track record.

Historical Performance

Fundrise has a track record of delivering attractive returns to its investors. Since its inception, the platform has achieved an average annualized return of 8.74% across its various investment plans. These returns are net of fees and expenses, providing a clear picture of the performance investors can expect.

Average Annual Returns

The average annual returns achieved by Fundrise are competitive when compared to other investment options. While returns can vary depending on market conditions and individual investment choices, Fundrise offers the potential for attractive risk-adjusted returns over the long term.

Comparison to Other Investment Options

When compared to traditional investment options, such as stocks, bonds, or savings accounts, Fundrise has the potential to offer higher returns due to the nature of real estate investing. However, it's important to note that real estate investments also carry additional risks, which should be carefully considered before making any investment decisions.

Tax Considerations

Investing in real estate can have significant tax advantages compared to other investment options.

Tax Advantages of Real Estate Investing

Real estate investments often come with various tax benefits, such as depreciation deductions, tax-free exchanges, and potential tax advantages associated with rental income. These advantages can help reduce the tax burden on investors and increase the overall after-tax returns of their investments.

Fundrise Tax Implications

When investing with Fundrise, investors receive income distributions from the investments they hold. This income is generally subject to ordinary income tax rates. Additionally, investors may also realize capital gains or losses when selling their investments.

As tax regulations can be complex and subject to change, it's important to consult with a tax professional before making any investment decisions. A tax professional can provide guidance on the specific tax implications of investing with Fundrise based on individual circumstances.

Seeking Professional Tax Advice

Given the potential tax implications associated with real estate investing, it's advisable to seek professional tax advice before making any investment decisions. A tax professional can provide guidance on how to structure investments, minimize tax liabilities, and optimize overall after-tax returns.

Fundrise vs. Other Real Estate Investment Options

When considering real estate investment options, it's important to compare Fundrise to other alternatives, such as direct real estate investment, REITs, and crowdfunding platforms.

Comparison to Direct Real Estate Investment

Investing directly in real estate typically requires a significant amount of capital and comes with ongoing management responsibilities. While direct investment can offer greater control and customization, it can also be more time-consuming and require a higher level of expertise.

Fundrise provides an opportunity for individuals to invest in real estate indirectly, without the need for significant capital or active management. This makes it a convenient and accessible option for those looking to diversify their investment portfolio with real estate exposure.

Comparison to REITs

REITs are investment vehicles that allow investors to pool their funds and invest in a portfolio of income-generating properties. While REITs offer liquidity and diversification, they often come with higher fees compared to Fundrise. Additionally, traditional REITs are primarily targeted towards institutional investors, making them less accessible to individual investors.

Fundrise, on the other hand, offers lower fees, greater accessibility, and the potential for attractive risk-adjusted returns. The platform's focus on individual investors and its innovative approach to real estate investing make it an appealing alternative to traditional REIT investments.

Comparison to Crowdfunding Platforms

Crowdfunding platforms have gained popularity in recent years as a way for individuals to invest in real estate projects. These platforms allow investors to browse and invest in a wide range of real estate deals, often with low investment minimums.

While crowdfunding platforms provide an opportunity for investors to access real estate investments, they often lack the comprehensive due diligence, professional management, and portfolio diversification offered by Fundrise. Fundrise combines the advantages of crowdfunding with the expertise and diversification strategies of a professional investment manager, offering a unique real estate investment experience.

Fundrise Accessibility

Fundrise strives to make real estate investing accessible to a wide range of individuals. Here are some key points regarding accessibility to consider:

Minimum Investment Requirements

Fundrise offers a low minimum investment requirement of $500, making it accessible to individuals who may not have a large amount of capital to invest. This low barrier to entry allows more people to participate in real estate investment and potentially benefit from the potential returns offered by the platform.

Accessibility to Non-Accredited Investors

One of the defining features of Fundrise is its accessibility to both accredited and non-accredited investors. While many traditional real estate investment opportunities are limited to accredited investors, Fundrise opens up the world of real estate investing to a broader audience.

Online Platform Convenience

Fundrise operates entirely online, allowing investors to access and manage their investments from anywhere with an internet connection. This convenience makes it easy for investors to stay informed and make investment decisions at their own pace.

Real Estate Market Trends

Understanding the current state of the real estate market and the factors that can impact it is crucial when making investment decisions.

Current State of the Real Estate Market

The real estate market is influenced by various factors, such as supply and demand dynamics, interest rates, economic conditions, and demographic trends. It's important to stay informed about these factors to assess the potential risks and opportunities associated with real estate investing.

Impact of Economic Factors on Real Estate

Economic factors, such as GDP growth, employment rates, and consumer confidence, can have a significant impact on the real estate market. Strong economic growth and favorable market conditions can create opportunities for real estate investors, while economic downturns can create challenges.

Fundrise closely monitors economic factors and adjusts its investment strategies accordingly to identify opportunities and manage potential risks in the market.

Growth Opportunities in Specific Markets

Certain cities and regions may offer unique growth opportunities due to factors such as population growth, job growth, and infrastructure development. Fundrise actively seeks investment opportunities in emerging markets that offer the potential for long-term growth and attractive returns.

These growth opportunities provide investors with the potential to benefit from the appreciation of property values and the generation of consistent rental income.

Investor Protection and Regulatory Compliance

When investing with Fundrise, it's important to understand the measures in place to protect investors' interests and ensure regulatory compliance.

Regulation A+ Qualification

Fundrise operates under Regulation A+ of the JOBS Act, which allows it to offer investments to both accredited and non-accredited investors. This regulation provides certain investor protections, including audited financial statements, ongoing reporting requirements, and requirements for independent valuation of the assets.

SEC Oversight

Fundrise is registered with the Securities and Exchange Commission (SEC) and is subject to the regulatory oversight of the SEC. This oversight helps to ensure that investor interests are protected and that the platform operates in compliance with applicable securities laws.

Fundrise Investor Protection Measures

Fundrise has implemented various measures to protect investors' capital and interests. These measures include rigorous due diligence on potential investments, proactive asset management, regular monitoring of portfolio performance, and transparent reporting to investors.

By employing these investor protection measures, Fundrise aims to provide a secure and transparent investment experience for its investors.

Conclusion

Fundrise offers individuals a unique opportunity to invest in high-quality real estate assets with ease and convenience. By leveraging the power of crowdfunding, Fundrise has transformed the traditionally exclusive world of real estate investment and made it accessible to all.

With a range of investment options, attractive returns, and a commitment to investor protection, Fundrise provides an attractive alternative to traditional real estate investment methods. Whether you're a seasoned investor or just starting out, Fundrise offers a user-friendly platform that allows you to participate in the potential growth of the real estate market and build wealth over the long term.

It's important to carefully consider your own investment goals and risk tolerance before investing with Fundrise or any other real estate investment platform. By doing so, you can make informed investment decisions that align with your financial objectives and set yourself on a path to long-term success.